- Home

- Share Prices

- AQSE Share Prices

- Euronext

- Stock Screeners

- Share Chat

- FX

- News & RNS

- Events

- Media

- Trading Brokers

- Finance Tools

- Members

Latest Share Chat

In rising stock markets, investors should search for value opportunities

Monday, 29th April 2024 10:21 - by David Harbage

As appetite for risk assets has increased - driven by the consensual expectation of cheaper money (“it’s only a question of when, not if, interest rates fall”) and “travelling is better than arriving” (markets move in anticipation of events or news) - it is not surprising to see astute investors buy the obvious value, which we have sought to identify in previous blogs, in deeply discounted investment trusts.

We confidently expect to see more of the same corporate action - both in the form of mergers & acquisitions (M&A) within the closed-end industry and astute hedge fund buying (a la US investor Sabre, which bought disclosable stakes in eleven UK listed investment trusts late last year) - in the months ahead, together with such sentiment impacting more widely to be “a tide than raises many more boats”.

In particular we remain keen where share prices offer big discounts to underlying asset worth - such as Harbourvest Global Private Equity (HVPE), Schroder Real Estate Income (SREI), Tritax Eurobox (EBOX) and Pershing Square (PSH). The private equity and property vehicles are on discounts of 30-40%, and have yet to respond to the prospect of lower interest rates, while the shares of the last named - which is invested in listed US equity - has already performed well, but is still priced at an appealing 25% discount to its individual constituents’ market valuation.

However, a wider raft of undervalued, but quality (featuring impressive longer term track records of good performance) trusts in neglected segments of real assets - most notably Smaller Companies, especially in the UK - continue to provide an opportunity to invest in well-managed diversified portfolios on attractive, double-digit discounts to their net asset values. The likes of local small cap specialist Aberforth Smaller Companies (ASL), UK mid sized focused Mercantile (MRC) & Schroder UK Mid Cap (SCP), domestic multi-cap Value investor Artemis Alpha (ATS) & Baillie Gifford UK Growth (BGUK), international equity Value-seeker AVI Global (AGT) and environmental utility Greencoat UK Wind (UKW) readily come to mind.

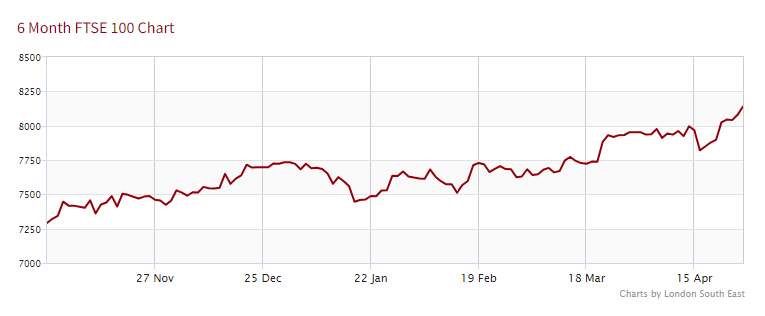

With plenty of geo-political ‘noise’ to unsettle the nervous, this writer would continue to argue that investors should seek more attractively priced assets than the most highly rated (and therefore those that are likely to fall furthest on any disappointment) which might be commanding most media attention. Despite our nation’s natural pessimism, which has been reflected in a relatively unloved FTSE 100 (despite the index reaching a new high of 8,145 on Friday last, it has lagged the US and many global stock markets), UK equity continues to represent the best value amongst major developed markets - based on price-to-earnings, price-to-asset and dividend yield metrics. Closed-ended investment trusts - where fund managers are not obliged to sell underlying holdings, incidentally - typically offer better value (with a few exceptions of the premium priced), but prospective owners should always carry out their own research and not invest monies which may be required in the short to medium-term.

The Writer's views are their own, not a representation of London South East's. No advice is inferred or given. If you require financial advice, please seek an Independent Financial Adviser.