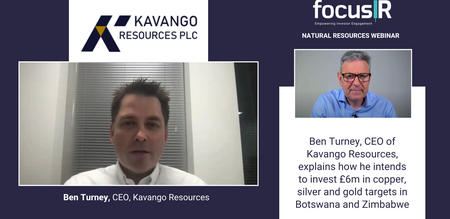

Kavango Resources CEO Ben Turney joined #LondonSouthEast live to present a new direction for the business and to take live questions at our July London South East/focusIR webinar.

Kavango Resources plc (LSE:KAV), is a Southern Africa focussed metals exploration company with exploration interests in Botswana’s Kalahari Copper Belt, and now Matabeleland in Southern Zimbabwe.

Ben used his slot on London South East to outline a new direction for the Kavango business with plans for bulk mining near Bulawayo in Southern Zimbabwe. As Ben explained, the people in Zimbabwe are well educated and keen to use mining to improve their standard of living. He pointed to Caledonian Mining as an example of what's it's possible to achieve there, with 14 consecutive quarters of dividends paid. However he did say that 'this is not a jurisdiction for the faint of heart'.

KAV have signed a 2-year option to acquire the Nara Project, a producing gold exploration project with 48 contiguous gold claims and the potential to host a bulk mineable gold deposit in Matabeleland. And Ben told us about the prospective purchase of two other new nearby projects, Hillside and Leopard, with due diligence about to be done on all three deals.

"We've negotiated favourable terms and are able to perform field due diligence, and these all have walk up drill targets. We are going to test their potential as quickly as we can with modern drill techniques. If they don't meet our criteria to make the investment then we will move on. We have a pipeline of at least a dozen other opportunities we are working on."

Kavango announced a potential £6M equity investment in 2 parts in May. Ben confirmed that Part 1 has completed and Purebond Ltd now own 26.7% of the company. If stage 2 completes that will move to 52.5% of the business. As this takes ownership above 50%, under the Takeover Code this requires a 'whitewash' which needs shareholder approval. "I wouldn't describe it as a takeover" said Ben. "Purebond haven't asked for a board seat, we have put together a relationship agreement with them and they haven't indicated any interest in taking over the company."

Ben said that a Purebond prospectus is about to published as part of the Purebond financing deal and that the prospectus will contain more financial detail. "In summary we are targeting half a million ounces on each of the (three) project areas, that's our goal." he said.