- Exclusions and inclusions top the list, according to AIC survey of private investors

- Desire for greater consistency and independent accreditation is strong

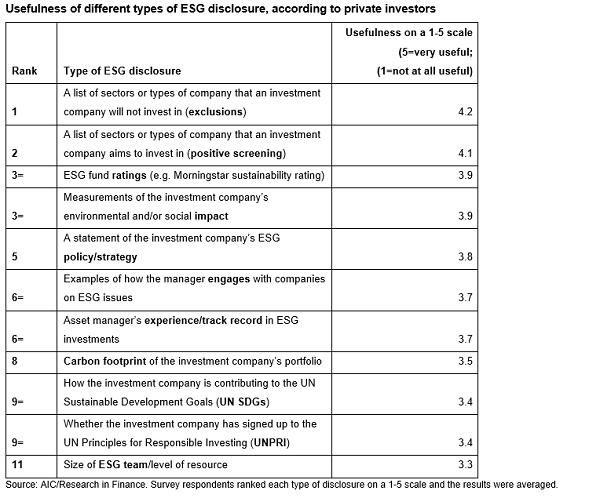

A list of sectors or types of company that an investment company will not invest in (exclusions) is the most useful ESG disclosure for private investors, according to research1 from the Association of Investment Companies (AIC).

Although investors are not convinced that exclusion is the answer, with 55% of respondents saying it is better to engage with companies than divest2, a list of exclusions still ranked highest among 11 types of ESG disclosure, according to the study of 402 private investors conducted by Research in Finance.

It was closely followed by a list of inclusions, sectors or types of company that an investment company aims to invest in – also known as positive screening.

ESG fund ratings, for example a Morningstar sustainability rating, were regarded as the joint third most useful ESG disclosure by investors, along with measurements of the investment company’s environmental or social impact.

Usefulness of different types of ESG disclosure, according to private investors

Respondents’ comments revealed a strong desire for greater consistency among ESG disclosures as well as independent accreditation, to help benchmark funds against each other.

One respondent commented: “For organic products, there is the Soil Association so you know that if you buy a product that has got the association mark, that actually their organic standards are really stringent and you know you have got a good product. With something like ESG investing, would there be an equivalent?”

Annabel Brodie-Smith, Communications Director of the Association of Investment Companies (AIC), commented: “Private investors are clearly interested in ESG disclosures, and find several types of disclosure useful. However, there’s a preference for the clear and factual over disclosures that may seem more abstract or subjective.

“We introduced ESG disclosures on our website last year so investors can compare the ESG policies and strategies of investment companies alongside performance data and other essential facts and figures. Since then we have gathered feedback from both private investors and professionals to help us and our members improve the disclosures over time.”

You can read more about the AIC’s ESG research here.