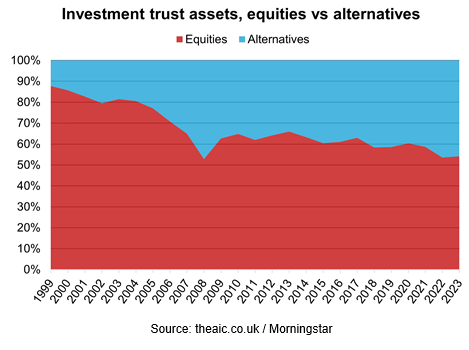

- Alternatives now make up 46% of investment trust assets, versus 12% in 1999

- 76 investment trusts have more than £1 billion in assets; 92 are in the FTSE 250

The investment trust industry has seen great change over the course of the 21st century so far, new analysis from the Association of Investment Companies (AIC) reveals.

At the end of 1999, 88% of investment trust assets were invested in equities and only 12% in alternatives (mostly private equity).

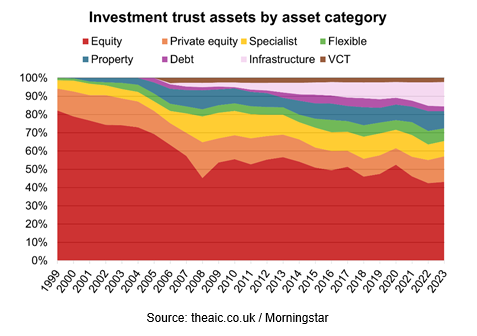

Today, the split is much more even, with 54% of investment trust assets in equities and 46% in alternatives, including significant allocations to private equity (14%), infrastructure (13%) and property (9%). Debt funds make up 3% of industry assets and venture capital trusts (VCTs) make up 2%.

Industry assets have increased from £78 billion at the end of the 20th century to £267 billion today. There are currently 365 investment trusts including VCTs, versus 334 at the end of 1999.

The average size of an investment trust has increased from £233 million in 1999 to £735 million today, measured by total assets. The number of investment trusts with more than £1 billion of total assets has increased from ten in 1999 to 76 today and has also doubled over the past seven years due to investment growth, fundraising and mergers.

Investment trusts now make up 92 of the FTSE 250, more than a third of the index. In contrast, only 38 investment trusts were members of the FTSE 250 at the end of 2002, less than one sixth of the mid-cap benchmark.

Four investment trusts are in the FTSE 100, compared to one in 1999.

Richard Stone, Chief Executive of the Association of Investment Companies (AIC), said: “The investment trust landscape has been completely reshaped since the turn of the millennium. An industry that was focused predominantly on equity investments has now branched out into a broader range of alternative asset classes. Nearly half of investment company assets are now invested in alternatives, including many that barely featured in 1999 such as infrastructure, direct property and private debt.

“The demand for larger, more liquid investment trusts has seen the average size of an investment trust increase, a trend that has gathered pace over the past decade.

“Since 1868, investment trusts have proven their ability to evolve to meet investor needs, and this continues today.”