Are you pondering over the idea of investing in gold? Step into the world of possibilities with VT Markets, where gold trading becomes an experience that’s safe, fast, and secure. Ditch the conventional avenues like jewellery and bullion purchases; dive into the dynamic gold trading market that has gained remarkable momentum over the past 15 years.

Gold as an investment vs. jewellery

Gold as an investment typically involves buying physical gold in various forms, such as bars, coins, or through financial instruments such as our platform. In investing terms, we are looking to profit from the purchase and sale of gold through trading.

Jewellery, on the other hand, is primarily a personal asset with aesthetic and sentimental value. While it contains gold, the purchase of jewellery is more about personal adornment and cultural significance rather than being a strategic financial investment with sufficient returns.

Why gold shines on our platform

Investing in gold and precious metals has long been trusted for wealth preservation and diversification in investment portfolios. Gold’s reputation as a secure asset has proven resilient during economic downturns. However, while it offers advantages, it might not align with everyone’s investment goals.

Why gold deserves a spot in your portfolio

Gold has historically emerged as a sought-after asset during geopolitical tensions and economic uncertainties. In 2023, central banks bolstered their gold reserves by a staggering 87%, highlighting its appeal as a store of value.

With global inflation projected around 6.7% in 2023, gold served as a hedge against inflation. Its price rise paralleled the increase in global inflation, showcasing its role as an inflation shield.

Gold’s price movements often have a low correlation with traditional assets like stocks and bonds. This diversification potential reduces overall portfolio risk and offers stability during market downturns.

Why did gold prices soar in 2023?

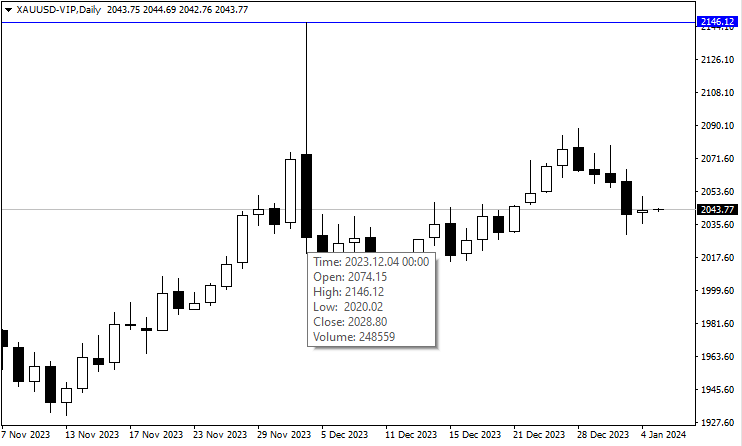

During the year, gold prices reached an unprecedented peak, hitting $2,146 on December 4th (as reported on VT Markets MT4). This surge represented a notable 17% increase from the opening price recorded on January 3rd, 2023, which stood at $1,827. The upward trajectory of gold prices during this period can be attributed to five key triggers:

The year began with the US banking crisis, prompting risk-averse investors to flock toward gold’s safety net.

Despite fluctuations in the second and third quarters, the Israel-Hamas conflict in Q4 reignited demand for gold as a store of value.

The Federal Reserve’s inclination toward potential rate cuts in 2024 weakened the dollar, enhancing gold’s appeal.

Large-scale strategic gold purchases by central banks exerted additional upward pressure on prices.

Q4 witnessed robust gold buying during the Indian festive season.

What’s glittering on the horizon in 2024?

Analysts anticipate the continued strength of the gold market for 2024 and beyond. Factors like the Fed’s plans to cut interest rates in 2024 and 2025 might bolster gold prices further. Additionally, ongoing tensions in the Middle East could spur strong demand for gold if they escalate.

Investing in gold remains a compelling option, given its historical performance and its role as a hedge against various economic uncertainties. As always, it’s crucial to consider your investment goals and consult with financial experts before making any decisions.