- Average investment company returns £6,089 on £1,000 over 18 years

- Biotechnology & Healthcare companies top the performance charts

With Christmas around the corner, children are eagerly waiting to start opening advent calendars and counting down the days to see what might be under the tree for them. But parents and grandparents wanting to give a gift that lasts a bit longer might like to consider making an investment for their child. A gift like this could grow into a nest egg and make a big difference towards education costs or a deposit for a first property.

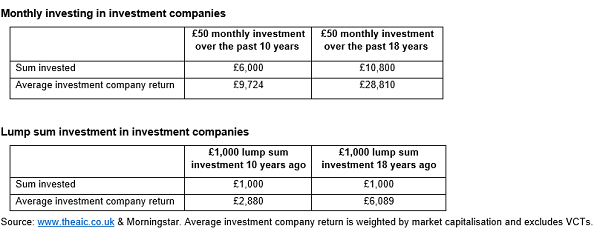

If a parent, grandparent or guardian had invested a one-off £1,000 in the average investment company for a child 18 years ago, it would now be worth an impressive £6,089 (a 509% return), or annualised return of 9.9%. If they preferred to make monthly contributions instead, for example £50 a month, their total investment of £10,800 over 18 years would now be worth £28,810. That could help towards a deposit on a first home or a considerable chunk of further education costs.

The top performing investment company sector over the last 18 years is Biotechnology & Healthcare, with a total return of £9,103 for every £1,000 invested. This is followed by Private Equity (£9,073), Asia Pacific Smaller Companies (£8,933), European Smaller Companies (£7,889) and Global (£7,729).

Annabel Brodie-Smith, Communications Director of the Association of Investment Companies (AIC), said: “After two disrupted Christmases due to Covid, this year we’re all looking forward to being together with family and loved ones. But with the cost of living crisis and now a recession, the financial demands on young people are becoming ever greater. Our annual student debt research found that two-fifths of students not planning to go to university identified debt worries as one of the reasons, so parents and grandparents might want to consider investing to give their child a head start.

“Investment companies benefit from the long-term growth potential of the stock market. They offer a way to spread investment risk through a diversified portfolio of investments. Over long periods, investment companies have delivered strong performance. A £50 monthly investment in the average investment company over the past 18 years would now be nearly £29,000, enough to make a big contribution to a young person’s financial future. Saving within a Junior ISA will ensure that any income and capital gains are tax-free even after your child turns 18.”

For more information on saving for children with investment companies, visit the dedicated page ‘Saving for your children’s future?’ on https://www.theaic.co.uk/ which has six tips on saving for children, as well as a video, guide and jargon buster.