‘E’ of ESG is most important to investors as a whole.

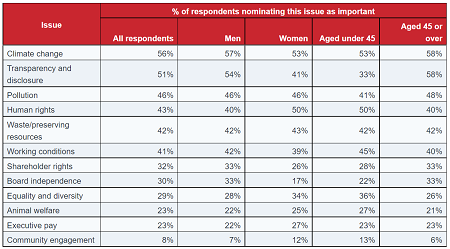

Climate change tops the list of most important ESG issues, with 56% of investors saying that it matters to them, according to a survey of 454 private investors by the Association of Investment Companies (AIC) (1).

With COP26 underway, climate change is the most important issue across age and gender, with 57% of men finding it important, 53% of women, 53% of investors aged under 45, and 58% of investors aged 45 and over (jointly with transparency and disclosure).

It is followed by transparency and disclosure (51%), pollution (46%) and human rights (43%). There was some disparity between younger and older investors, with those aged 45 and over finding transparency and disclosure more important than those under 45, and human rights ranking higher with younger respondents.

The research also found that just under two-thirds of private investors (65%) consider ESG issues when investing, with a marked difference between those under 45 (77%) and those of that age or older (61%).

Importance of various ESG issues to private investors

Source: AIC/Research in Finance. Each respondent could select up to 5 issues that were important to them when investing.

E, S or G?

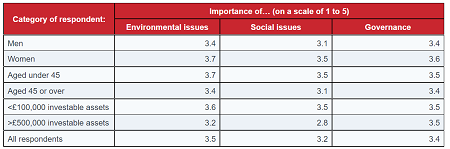

The survey also asked respondents how important environmental, social or governance issues were to them when investing.

Overall, environmental issues – the ‘E’ of ESG – are seen as slightly more important, ranked as 3.5 on a scale of 1 to 5. Governance issues (‘G’) follow with a ranking of 3.4 and social issues (‘S’) with 3.2.

However, there are differences depending on investors’ age, gender and wealth (measured by level of investable assets).

Social issues are more important to those with less money to invest, with those who have less than £100,000 in investable assets ranking them as 3.5 on a 1-to-5 scale of importance, compared with a ranking of 2.8 for those with more than £500,000 of assets.

Social issues are also more important to women (3.5) than to men (3.1).

Wealthier investors prioritise governance over environmental and social considerations, with those with more than £500,000 of investable assets ranking governance issues as 3.5 on the 1-to-5 scale, compared with rankings of 3.2 for environmental issues and 2.8 for social issues.

Importance of environmental, social and governance issues to different demographic groups

Source: AIC/Research in Finance. Respondents ranked each issue on a 1-to-5 scale, with 5 being most important.

AIC comment on the research

Annabel Brodie-Smith, Communications Director of the Association of Investment Companies (AIC), said: “This research shows that the ‘E’ of ESG looms largest in the minds of the investing public, though social issues are important to younger investors and wealthier investors are most concerned about governance matters.

“The fact that climate change, pollution and the prevention of waste rank so highly among investors’ concerns is another sign of the dominance of environmental issues when it comes to ESG. With transparency and disclosure ranked as investors’ second biggest ESG concern, this is likely to lead to greater demand for clear, accessible information on asset managers’ environmental policies and the impact of underlying investments on the planet.”

1 An online survey of 454 private investors was commissioned by the Association of Investment Companies (AIC) and conducted by Research in Finance. Respondents were mixed by age and gender, investable assets and region but all had at least some money to invest and owned at least one investment product. All respondents self-select some of their investments, though 35% also invest through a financial adviser or wealth manager. The online survey was followed by 10 in-depth phone interviews with selected participants to gain further insights. Fieldwork was conducted between 7 June and 25 August 2021.