- Home

- Share Prices

- AQSE Share Prices

- Euronext

- Stock Screeners

- Share Chat

- FX

- News & RNS

- Events

- Media

- Trading Brokers

- Finance Tools

- Members

Latest Share Chat

Volume Buying Zenith Energy

Wednesday, 5th January 2022 09:58 - by Moosh

My first volume buy I tried was in Zenith Energy (LSE:ZEN). In early July 2021, I noticed a news driven spike in volume so I thought I would follow the volume. As it was the initial test out of volume buying, I scaled down the buy and starting from mid March I calculated 10,527 shares which were bought on 22 July 2021 for £106.94. these were sold on 29 July 2021 for 14% profit.

Well that seemed a bit too easy for such a small value and I wondered if it was beginner’s luck!

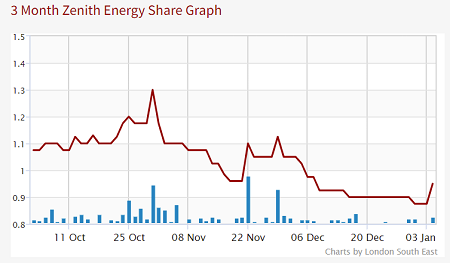

Above: ZEN three month chart

I tested ZEN out again in the next price cycle, starting the cumulative calculation of volume buys from the July 2021 price peak, but this time scaled up the buys by 50% on top of the standard buy size. Here are the buys:

18 August 2021

- 12,384 shares, £140 (break even 1.195p)

21 August 2021

- 12,968 shares, £140 (total 25352 shares, £280, break even 1.136p)

15 September 2021

- 10,941 shares, £120 (total 36293 shares, £400, break even 1.1242p)

These were sold on 25 October 2021 for 8.5% profit. The buys satisfied the rule that they should average down the total holding.

ZEN is a low volume company with regular newsflow. I didn’t see low volume as a barrier to not investing since volume buys allow me to have exposure and capitalise on the opportunity but in a size proportional to recent market activity in ZEN.

- Catch up with Moosh's previous blog posts here

As ZEN price rose in October, it was useful to monitor the trend as volume exceeded the 20 day average volume on the following days after my last buy:

September 16, 17, 21, 24

October 6, 12, 18, 22, 25

Reference

Pump Up the Volume – 20 December 2021 blog entry

Trend identification – 22 December 2021 blog entry

The Writer's views are their own, not a representation of London South East's. No advice is inferred or given. If you require financial advice, please seek an Independent Financial Adviser.