- City of London most viewed for second year

- Full ranking below

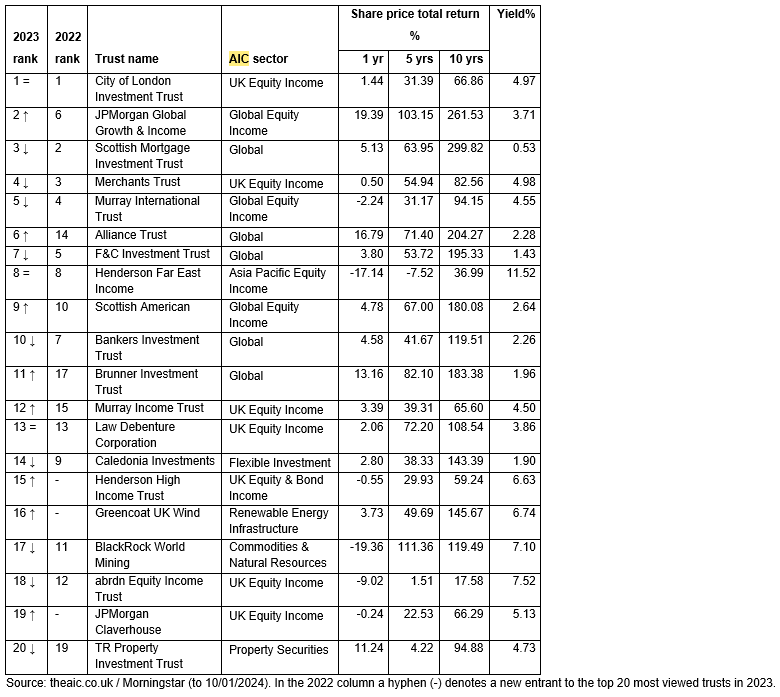

The Association of Investment Companies (AIC) has published a list of the 20 most viewed investment trusts on its website theaic.co.uk during 2023.

With slowing economic growth and high inflation, income-focused trusts continue to attract website users’ interest. More than half (12) of the 20 most viewed trusts are AIC dividend heroes, investment trusts that have increased their dividends for at least 20 years in a row. A further five have increased dividends for at least ten years but less than 20.

Eleven of the 20 are from the equity income sectors, seven of which are focused on UK equities. The current average yield of the 20 most viewed trusts is 4.4%, compared to 3.5% for the average investment trust.

Top 20 most viewed investment trusts on theaic.co.uk in 2023

Top five

City of London (CTY) was the most viewed trust in 2023, as it was in 2022. Managed by Job Curtis, it invests in UK equities and has the longest track record of consistently increasing its dividend every year, having done so for the last 57 years. With more than £2.1 billion of total assets, it delivered a share price total return of 1.4% over the last 12 months and yields 5.0%.

JPMorgan Global Growth & Income (JGGI) was the second most viewed company and the best performing company from the Global Equity Income sector. It has total assets of £2.2 billion and delivered a return of 19.4% over the last 12 months following its merger with Scottish Investment Trust in September 2022.

In third place was Scottish Mortgage (SMT), which consistently features among the most viewed trusts. The FTSE 100 constituent has consistently increased its dividend for 41 years and delivered a return of 5.1% over the last 12 months and 299.8% over the past ten years. Completing the top five were Merchants Trust (MRCH) and Murray International Trust (MYI) having returned 0.5% and -2.2% respectively over the last 12 months and yielding 5.0% and 4.6%.

New entries

There were three new entries to the top 20 ranking which did not feature in 2022’s list. Henderson High Income (HHI) was the highest-ranked of these in 15th place. In October the trust announced a proposed merger with Henderson Diversified Income.

The other new entrants to the most viewed ranking were Greencoat UK Wind (UKW) (16th) and JPMorgan Claverhouse (JCH)(19th).

Annabel Brodie-Smith, Communications Director of the Association of Investment Companies (AIC), said: “With persistent inflation and an economic slowdown, it’s understandable that investment trusts with long track records of dividend growth were most popular with investors last year. Investment trusts have strong income benefits which can help them continue to pay dividends to investors even during tough times. However, it’s important to remember that dividends are never guaranteed.

“The AIC’s website provides a wealth of helpful investment trust information, from performance and discount data to portfolio holdings enabling investors to easily compare and choose trusts to meet their investment objectives. Users can get quick access to annual reports and factsheets without having to trawl through pages of information.”

For more information on how the AIC’s website can help investors research and monitor investment trusts, visit the Research tools page on theaic.co.uk.