- Mergers, buybacks, liquidations and manager changes dominate corporate activity

- Eight investment companies change managers, with one more expected in 2023

- Discounts have narrowed since their October nadir, from 16.9% to 11.1%

2023 has seen four mergers between investment companies, eight liquidations and eight investment companies change managers as boards responded to difficult market conditions and deep discounts, according to data from the Association of Investment Companies (AIC)1.

There will be nine manager changes in total following the appointment of Asset Value Investors to manage MIGO Opportunities on 15 December – the largest number of manager changes in a year since 2009.

The discount of the average investment company has remained in double figures through the whole of 2023, the only year this has happened since the financial crisis. The average investment company discount started the year at 11.7% and hit a post-2008 trough of 16.9% at the end of October before recovering to 11.1%2.

It has been a record year for share buybacks, with £3.57bn of shares repurchased in the year to date, compared to £2.70bn during the whole of 2022, a 32% increase, according to statistics from Winterflood and Morningstar3.

A total of £6.32bn was paid out by investment companies in dividends during the first 11 months of the year, compared to £5.55bn for the same period of 2022, an increase of 14%.

Industry assets were £260 billion at the end of November, slightly down from £265 billion at the beginning of the year.

Twenty-six investment companies changed their fees during the year to benefit shareholders.

See below for more details on mergers, manager changes, liquidations and fee changes.

IPOs and secondary fundraising

There were two initial public offerings (IPOs) in 2023 with Ashoka WhiteOak Emerging Markets Trust listing on the London Stock Exchange and raising £30.5 million, and Onward Opportunities listing on AIM in March and raising £12.8 million.

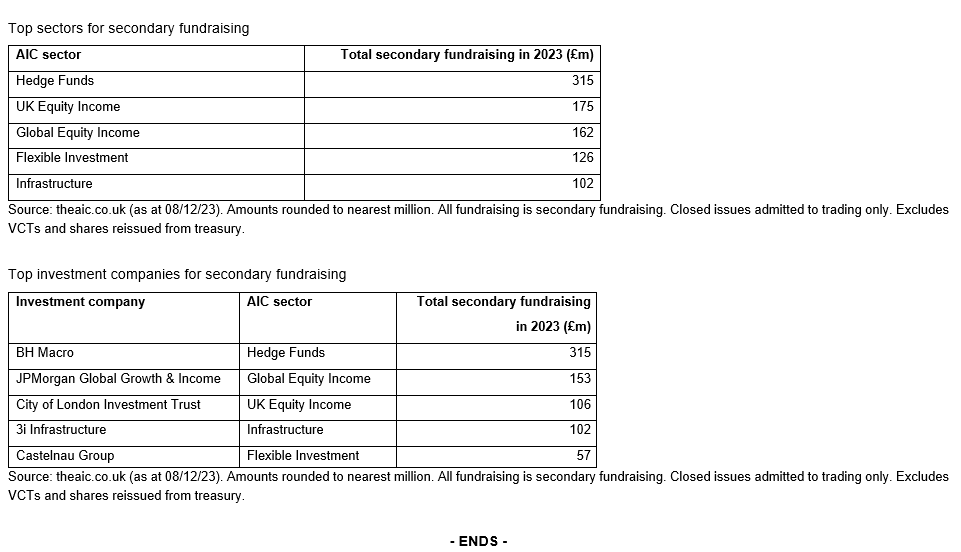

Fundraising by existing investment companies (called secondary fundraising) totalled £1.1 billion in the year to date, down from £5.2 billion last year as investor sentiment suffered from rapid increases in interest rates.

The secondary fundraising was led by the Hedge Funds sector which raised £315 million. This was followed by the UK Equity Income and Global Equity Income sectors, which raised totals of £175 million and £162 million respectively. For more details on secondary fundraising, please see the tables at the bottom of this release.

Richard Stone, Chief Executive of the Association of Investment Companies (AIC), said: “Investment company boards have worked hard this year to deliver value to shareholders in challenging market conditions. For some, this has meant buying back shares, while others have taken the more radical steps of changing manager, merging with another investment company or even winding up the company.

“Discounts on investment companies were historically wide this year and that has increased the attraction of share buybacks. Towards the end of the year we have seen discounts narrow as investors begin to believe that interest rates have peaked and could be heading downwards in the not too distant future.”

Performance in 2023

The average investment company has generated a share price total return of 5.1% in the year to date (to 8 December). The best performing sector over this period is Private Equity with a 48.7% return, followed by Technology & Technology Innovation (38.8%), North America (16.6%) and India/India Subcontinent (15.5%).

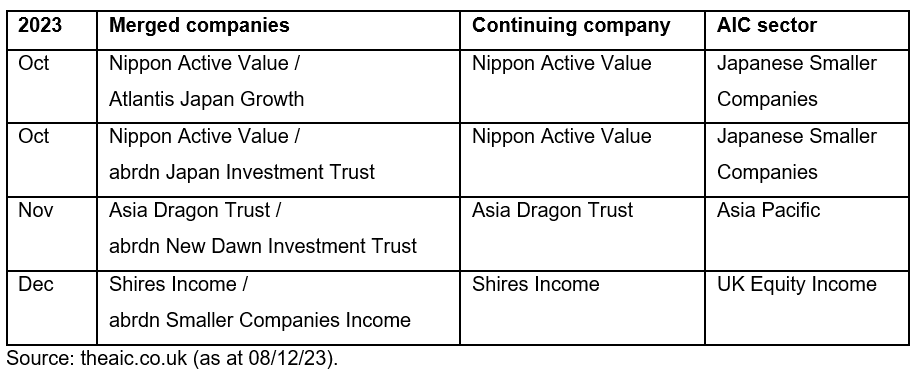

Mergers in 2023

Four investment company mergers completed in 2023, including two mergers for Nippon Active Value, which absorbed Atlantis Japan Growth and abrdn Japan Investment Trust.

An additional four mergers have already been announced and if approved are expected to complete in the first half of 2024. These include Henderson High Income with Henderson Diversified Income, JPMorgan MidCap with JPMorgan UK Smaller Companies, Troy Income & Growth with STS Global Income & Growth and abrdn China Investment Company with Fidelity China Special Situations.

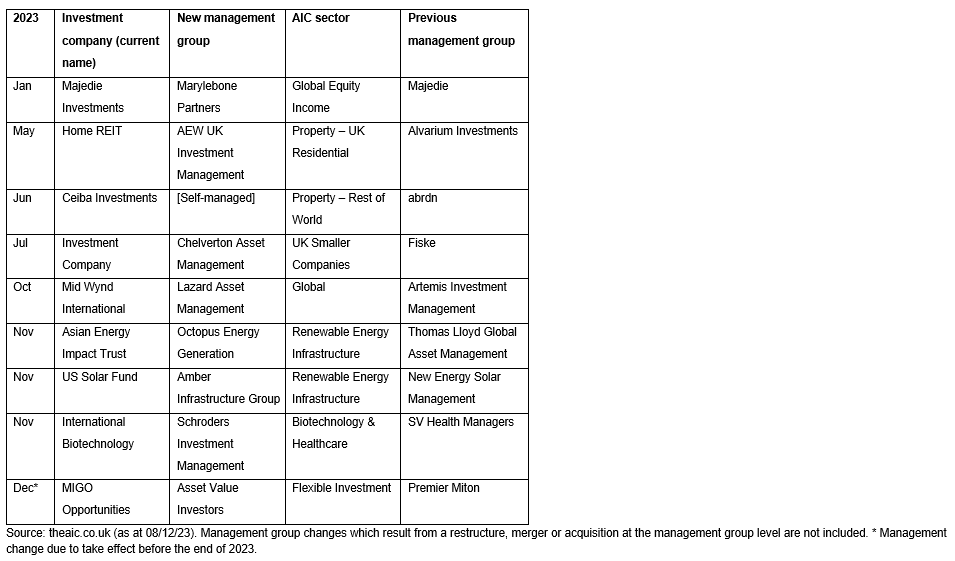

Manager changes in 2023

Eight investment companies changed their manager in 2023, with Ceiba Investments becoming self-managed and Mid Wynd International appointing Lazard Asset Management following the retirement of its manager Simon Edelsten. MIGO Opportunities’ move to Asset Value Investors is due to happen on 15 December, making nine manager changes in 2023 in total – the most in a calendar year since 2009.

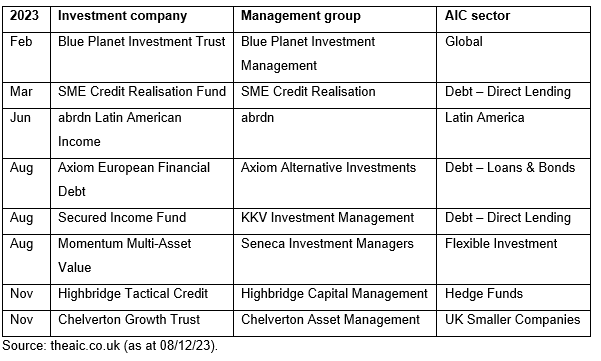

Liquidations in 2023

There have been eight liquidations of investment companies so far this year.

Fee changes

During the year, 26 investment companies changed their fees to benefit shareholders. The most common type of fee change was a reduction in a company’s base fee (11 companies) and the second most common was a reduction in a tiered fee (10 companies). In addition, 7 companies introduced tiered fees for the first time and two companies removed their performance fees4.

Fundraising in 2023 in detail

The Hedge Funds sector raised £315m in 2023, more than any other sector. This was entirely due to BH Macro, which was the investment company that raised most in 2023.

The UK Equity Income sector came second with fundraising of £175m, of which £106m was raised by City of London and £44m was raised by Merchants Trust.

1. All data, except for total assets data, excludes venture capital trusts (VCTs). VCTs make up £6.1bn of investment companies’ £260.1bn of assets.

2. As at 12 December 2023. The discount of 16.9% at the end of October was the widest month-end discount since the financial crisis. Average discount excludes VCTs.

3. In addition to the £3.57bn of share buybacks in the year to date (which is the greatest value of buybacks in a year since Winterflood’s records begin in 1996) there has been an additional £637m of shares repurchased through tender offers and redemptions, making £4.20bn in total. Source: Winterflood / Morningstar.

4. Companies may make more than one type of change at the same time (e.g. abolishing a performance fee while introducing tiered fees).

5. The Association of Investment Companies (AIC) represents a broad range of closed-ended investment companies, incorporating investment trusts and other closed-ended investment companies and VCTs. The AIC’s members believe that the industry is best served if it is united and speaks with one voice. The AIC’s vision is for closed-ended investment companies to be considered by every investor. The AIC has 341 members and the industry has total assets of approximately £260 billion.

6. For more information about the AIC and investment companies, visit the AIC’s website.

7. Disclaimer: The information contained in this press release does not constitute investment advice or personal recommendation and it is not an invitation or inducement to engage in investment activity. You should seek independent financial and, if appropriate, legal advice as to the suitability of any investment decision. Past performance is not a guide to future performance. The value of investment company shares, and the income from them, can fall as well as rise. You may not get back the full amount invested and, in some cases, nothing at all.