MAVT is neatly positioned to deal with the world’s economic problems…

We tend to think of investment trusts as being sector or region specific. Managers of a closed-ended fund might, for example, focus their efforts on Asia or the global technology sector. Even if a trust does have a broad remit, there do tend to be some limits on it. A fund with a remit to invest in global equities may be able to invest in companies across the globe but it can still only have exposure to equities, and is unable to diversify into bonds, property, alternatives or other assets.

Under these circumstances, achieving a level of diversification can mean trying to combine various trusts to get the desired outcome. This can be a frustrating and time-consuming process, particularly as there may be a level of overlap between trusts, which can end up resulting in unintended concentration risks for the investor.

However, there are some trusts which are able to invest in a broad range of assets and can thus provide a simple route to portfolio diversification. Momentum Multi-Asset Value (MAVT) is one of them. The closed-ended fund invests in a mix of UK and global equities, fixed-income, property, and alternatives. Fund manager Gary Moglione and his team analyse UK equities themselves but invest in funds to get exposure to the other asset classes in the portfolio.

The result of this process is a straightforward route to portfolio diversification for investors. This is true, not just because of the mix of assets that the managers hold, but also the investment approach they take to the markets.

Readers can probably gather from the ‘value’ part of the trust’s name that MAVT’s managers take a valuation conscious approach to their investments. Over the past few years that has meant, for example, avoiding lots of the froth we’ve seen in technology stocks – an approach which has served them well given some of the drastic declines in valuation the sector has experienced in 2022.

Of course, value investing can sometimes lead to managers taking stakes in companies which are, given their poor prospects, ‘cheap’ for a reason. The MAVT team is conscious of this risk and look to ensure they aren’t falling into any value traps when making their investments.

On the UK equities side, the team look beyond top line valuation numbers and dig into a company’s earnings to determine how sustainable they are and what their potential is moving forward. So even if they’re not willing to buy at massive valuation numbers, they also don’t want to fall into the trap of buying bad companies just because they have a low price.

This methodology is applied to the other investments the fund managers make, whether it be in alternatives or their global equity holdings. MAVT’s team describes the process it uses to make these decisions as ‘refined value’, with the goal being to have a more nuanced approach than regular value investing and to apply it across a broad range of asset classes, rather than just equities.

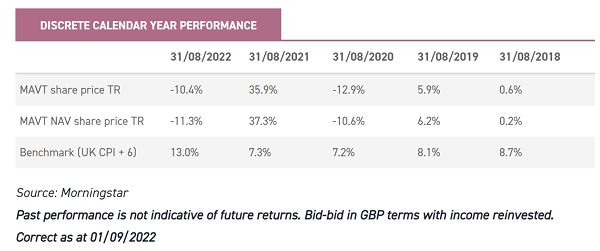

It's a process that has paid off historically, with the trust’s managers meeting their objective of delivering annualised, long-term returns greater than the UK consumer price index, plus 6%. Their approach also means that the portfolio tends to be structured in a unique way – beyond the fact that it offers a broad level of diversification.

For instance, when allocating to other managers, the MAVT team tend to favour small, boutique funds as they believe their managers are more likely to have ‘skin in the game’ and be incentivised to deliver better returns for shareholders. It has also meant they’ve tended to be far less US-centric on the global equities front than other comparable funds.

Moving forward, the trust looks well positioned to handle some of the macroeconomic headwinds we’re facing today. As noted, the trust’s investment objective is linked to inflation, with the aim to produce returns that are substantially in excess of the rate of currency devaluation.

One way the trust managers look to achieve this is through their exposure to alternatives, which currently comprise close to a third of the trust’s assets under management. That includes investments in things like music royalties, infrastructure, and debt instruments.

Income is a big part of the returns these holdings generate and the positive here is that a substantial portion have investments that are explicitly linked to inflation. The others that don’t have this connection still look capable of delivering higher pay outs in line with rising costs.

These sorts of holdings have enabled the trust to be consistent in paying out dividends to shareholders over the years, something that has continued into 2022 with the trust’s board recently announcing its first interim dividend for the current financial year and noting that it is “very likely” the final dividend will increase as inflation rises.

This is not a guarantee that will happen, nor is the trust likely to be immune from some of the problems that the global economy is facing. But the managers have always invested with these problems in mind and in an environment like this, that kind of experience has a value of its own.

Disclaimer

This report has been issued by Kepler Partners LLP. The analyst who has prepared this report is aware that Kepler Partners LLP has a relationship with the company covered in this report and/or a conflict of interest which may impair the objectivity of the research.

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that if you are a private investor independent financial advice should be taken before making any investment or financial decision.