Some choices are simple. Let’s say you have two options for your hard-earned savings and investments. Option 1 is giving money to the taxman and Option 2 is keeping all your money.If you’re a UK resident, you do have exactly that choice with Individual Savings Accounts (ISAs).Disclaimer: Tax treatments depend on the individual circumstances of each person and might be subject to change in the future.Big ideas

What is an ISA?

An ISA is a tax-free saving or investment account for UK residents. You can put your ISA allowance to work and maximise your potential returns by shielding them from income tax, tax on dividends and capital gains tax.ISA in UK parlance is sometimes referred to as a ‘Tax Wrapper’. Think of them like a force field sitting around your money, keeping the taxman away.

What are the UK taxes on investments?

To understand the value of using an ISA, it is worth taking a brief look at how taxes on savings and investments usually work in the UK, without using an ISA. That way you can see what the ISA is protecting you from.

Tax on interest

For interest earned on cash savings, if you are a basic rate taxpayer, you receive the first £1,000 in interest earned tax-free and then pay 20% on anything above this. Higher rate taxpayers receive £500 in interest earnings tax-free and then pay 40% tax on anything over that. Finally, additional rate taxpayers get no tax-free allowance at all and pay 45% tax on all interest received.

Tax on capital gains

This is a tax on profit made from owning an asset when you come to sell it. You are not taxed on investment profits until you sell and realise the gain. You get the first £12,300 of profit tax-free and then pay tax on amounts over this. The rates range from 10% up to 28% and it depends on what bracket of taxpayer you are (basic or higher etc) and what the asset is, for example, a different rate applies to property versus the stock market.

Tax on dividends

Many stocks and shares pay outdividends to investors, which is a type of income you receive, and yes, that is taxed too. You get the first £2,000 tax-free and then pay between 7.5% to 38.1% on the rest, depending on what income tax band you are in.Sadly, there is not a lot that the government doesn't tax! But an ISA is an easy way to avoid all of these (up to a certain maximum contribution), which keeps more in your pocket. Another benefit is that you don’t have to declare them on a tax return or report them in any way.

What are the different types of ISA accounts?

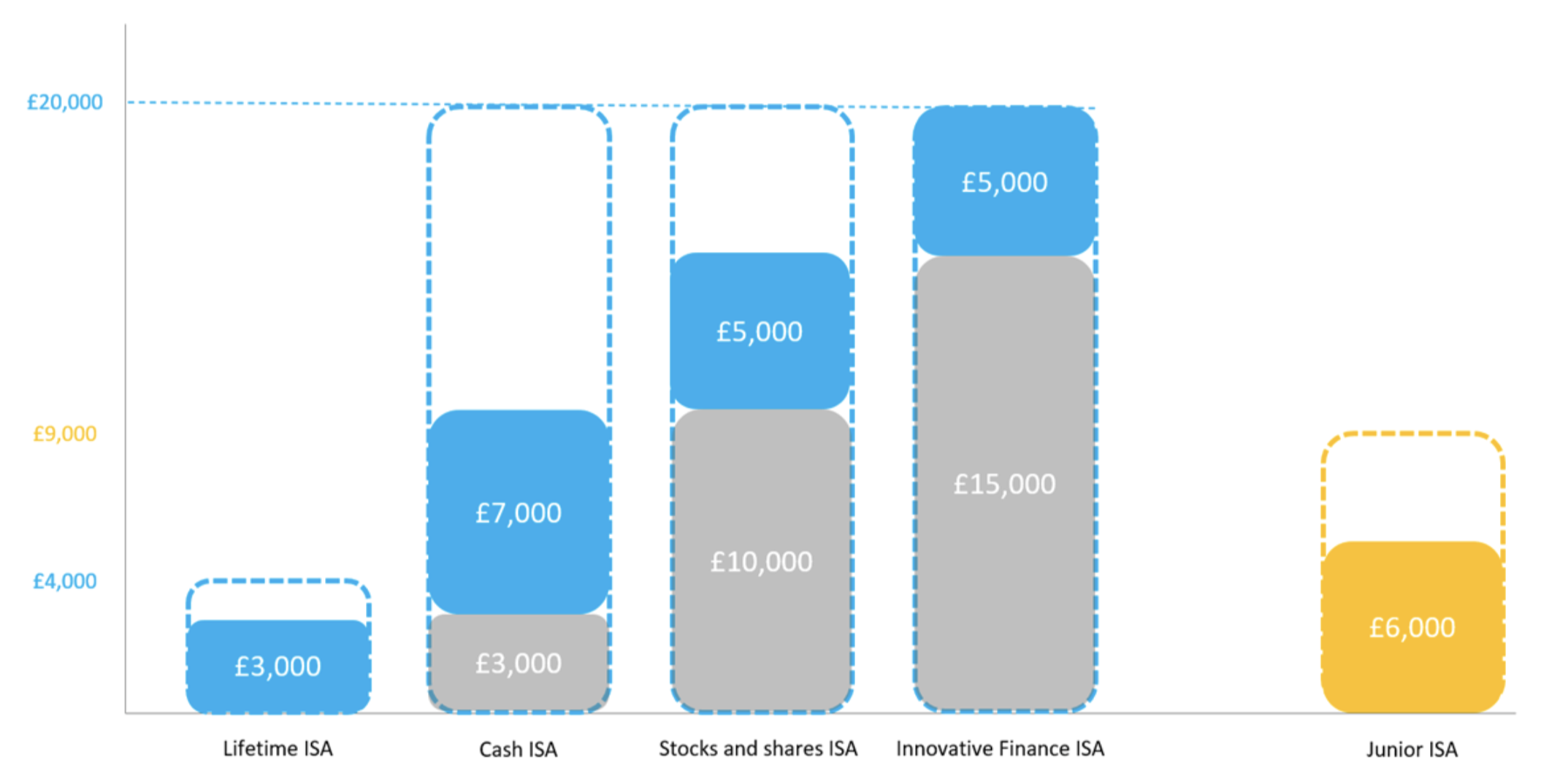

There are five main types of UK ISA accounts, with small variations among them:

For a cash ISA you have to be over the age of 16. Stocks and Shares and innovative finance ISAs over the age of 18 and to open a new Lifetime ISA you’ll have to be over 18 but under the age of 40.A Junior ISA replaced what was the Child Trust Fund for your dependents under the age of 18. To open one in the UK, you’ll need to be the parent or legal guardian if your child is under 16. If they’re 16 or over, the child can open one themselves. This is a cash Junior ISA as well as an investing version.Word of warning with Junior ISAs. Be aware that the children get control over the account when they turn 16 and can start withdrawing when they are 18.

About Stocks and Shares ISA accounts

In a Stocks and Shares ISA, generally, you can include the following types of investments:

Any investments held inside an ISA account will not be subject to income tax, tax on dividends or capital gains. So why don’t we just put everything inside an ISA? The answer is that there is a maximum allowance for how much you can deposit per year.You can choose to save across multiple accounts, as long as you don’t exceed the annual allowance for the current tax year, set at £20,000 at the time of writing.A Lifetime ISA has a reduced allowance of just £4,000 per year and a Junior ISA differs too with an allowance of £9,000 per year. These allowances fit inside the UK tax year which runs from 6th April to 5th April.

Rules for using your ISA allowance

You can use your annual allowance in full with either a cash or an investment ISA or an innovative finance ISA, paying up to £20,000 in the current tax year.Alternatively, you can split your ISA allowance, using it as you wish across the four different types (subject to individual account limits), as long as you don’t pay in more than £20,000 across them all, and no more than £4,000 into the Lifetime account.You are limited to using only one of each type in each tax year. A Junior ISA is counted outside of your allowance since that is technically in the name of the dependent you opened it for.

This year (2023), if you want to use a Lifetime ISA, you can deposit £4,000. You can then spread the remaining £16,000 of your allowance across any of the others in whatever proportion you want. If you don't want to use one, you can simply put in £20,000 in any one of the other 3, or a combination if you like, as long as you don’t exceed the total £20,000 allowance.

ISA withdrawals

Investing is for the long term, but you can still withdraw money when you need to from the Trading 212 Stocks and Shares ISA.

Don’t forget the value of investments will fluctuate, so your account balance may be up or down at the time of withdrawal. When you withdraw from your ISA, your investments need to be sold and the money is transferred back into your account as cash.

With whatever ISA you decide to take out, be sure to check the withdrawal rules before you open the account, so you know how these work.

With Trading 212, your ISA is ‘non-flexible’. What this means is any replaced withdrawals will count as a subscription for the tax year in which it is subscribed.

Imagine, you deposited £10,000 and decided to withdraw £1,000 later on. The balance in your ISA might be £9,000, but your current tax year subscriptions will remain £10,000. So if you decide to add more money afterwards in the same tax year, it will be added on top of your original £10,000, not the new £9,000 value.

Transferring to a new ISA provider

You can transfer your ISA from one provider to another at any time and you can transfer your money to a different type of ISA or to the same type of ISA. If you want to transfer the money you've invested in an ISA during the current year, you must transfer all of it.

With the Trading 212 stocks and shares ISA you can move as much of your ISA contributions from previous tax years as you like. However, if you wish to transfer the money you already put into your ISA this tax year, you'll need to transfer all of this year’s pot together.

Generally speaking, transfers take around 30 days, but this does vary depending on what providers are involved.

To instruct a transfer, you go to your new desired provider and follow their process to request it for you. At Trading 212, you fill out an ISA Transfer Authority Form , and Trading 212 will contact your previous provider to start the process.