There’s an old expression about investing -'It’s about time in the markets, not timing in the markets’.Financial markets go through periods of highs and lows so you would think a strategy to only buy near the lows and sell when markets were high would be the path to long-term profitability.However, the information presented in this article shows that even if you could time the market perfectly, you still might not get the best investment returns.Big ideas

A test of 3 market timing techniques

Let's take for example the investing journey of three friends. Tiffany, Brittany and Sarah.It's 1979, the three friends meet up. They all want to start investing and agree they can afford to invest a certain amount each month into the S&P 500 index, the top 500 businesses in America. They can agree on the amount and what they are going to invest, but they really cannot agree on when they should be investing the funds.Over 40 years of market data, you can compare three different timing approaches to investing a total of $96,000, which works out to $200 a month.The 3 timing approaches:

The three friends clearly had time on their side and it's this long-term approach that is the key to their success but the difference in results between the three is striking.When they sat back down 40 years later and compared results, who do you think had performed the best?Tiffany had terrible timing. She saved her money in a high-interest savings account and only pounced on the S&P 500 the day before a major crash. Right at the top. For example, she invested on Black Monday in 1987 or the day before the financial crash in 2008. But Tiffany never sold. She left the money to work and continued saving up in her savings account ready for the next market high. At the end of the 40-year period, Tiffany had invested $96,000 and had a very respectable $663,594.Brittany on the basis of her timing must be one of the best investors of all time. Saving her money again in a high-interest savings account and only bought at the very bottom of the four biggest crashes in that 40-year period. Brittany could not have bought at better times and she was rewarded. Her $96,000 turned into almost a million at $956,838.Sarah was not interested in market timing and simply invested her £200 dollars into the S&P 500 every month when she got paid. No savings, just consistently buying over the 40-year period and Sarah ended up with by far the most, $1,386,429.Example data source: Financial independence subreddit.

Timing the market vs buy and hold

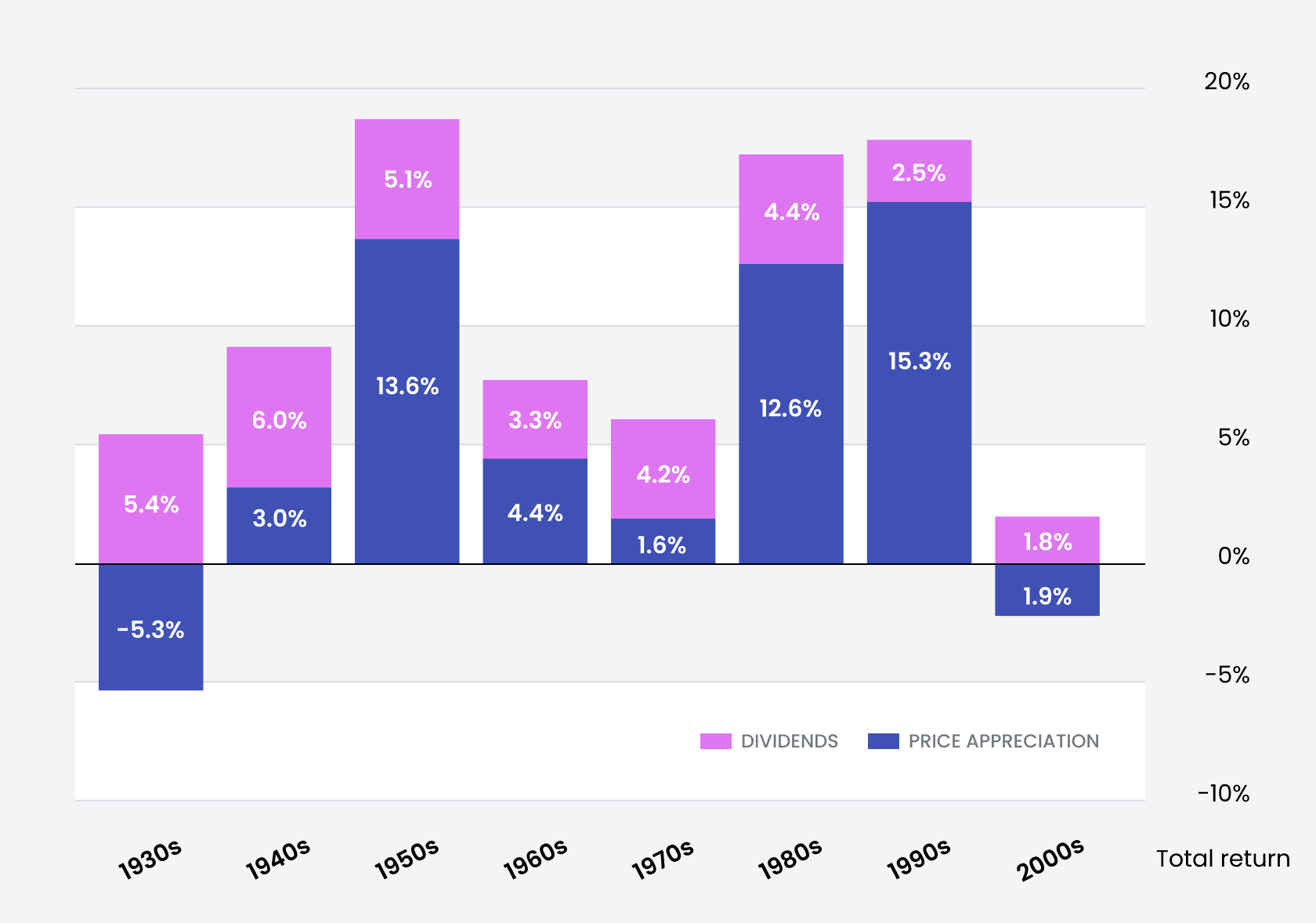

How is that possible? How can Sarah with her lazy approach beat the investing genius of Brittany who timed the market perfectly?Brittany with her impeccable timing only invested a handful of times over the forty years. This meant for large amounts of time her money was sat on the sidelines, earning a paltry 3% interest rate on her savings instead of being invested. When money is invested in the stock market, it is earning dividends, which can then be reinvested.

Estimates are that since 1926 32% of all the returns of all the money made from investing in the S&P 500 have been from dividend payments; the rest is in the growth of the value of businesses.

Breakdown of the S&500 total returns

What if you could pull your money out of the market when it is at highs and then buy back in at the lows? The goal of saving your portfolio from significant declines in stock values by selling everything at the top and sitting on your cash until the bottom, then buying back in, feels logical.

The problem is that it is almost impossible to do consistently. Even the best investors in the world fail to turn short-term investment options with high returns into a satisfactory set of long-term results. The problem is you don't just need to be right in your assessment of the market (that it has topped or bottomed) but you also need to time it correctly.

For example, Micheal Burry shorted Tesla stock in 2021 because he felt the TSLA price would fall because it was overvalued. He was right, it did fall in 2022 but the problem was that he was much too early and Tesla's price rose significantly after he made the bet, forcing him to close his position too soon. Investing early is akin to being wrong, because both cost you money.

Recap

If you are still not convinced and think timing the market is a good idea, consider this. Over the 40 years (10,000 days) that the ladies above invested, just 10 days accounted for nearly two-thirds of all the returns. So by trying to time the market, you are saying you are good enough to not miss any of those ten days. That would take a lot of skill and good luck.