The earlier you start investing, the better. You’ll never have more time ahead of you than you do right now, so what are you waiting for?Author James Clear argues that it is the little things we do every day in our lives that shape who we are.It isn't the big decisions we make (the new job, the move abroad or the ending of a relationship) that decides our life path. James instead argues that the regular practice of small habits really changes our lives. He calls them atomic habits, and while it might not be obvious the impact of those little things, with enough consistency, their influence on our lives can be immense.

Big ideas

Can you make money investing small amounts? Sylvia Bloom did.

Sylvia was born in New York in 1919 and from 1947 - 2014 she worked as a legal secretary for a Manhattan-based firm. Every day she would travel from Brooklyn on the subway to her place of work and for all intents and purposes, Sylvia and her husband lived happy but unremarkable lives.

Her secretary salary meant that Sylvia worked until the age of 94 before retiring and unfortunately died only 2 short years later. It was what happened upon her death that caught the attention of the world…

Sylvia left an $8.2 million donation to a local charity that claimed it was the largest single gift they had ever received in their 125-year history. Sylvia was sitting on millions, and no one had the faintest idea. Not even her poor husband, who worked multiple jobs up to the time he died. So what happened?

Her boss would ask her to do everything from the dry cleaning all the way to placing purchase orders for stocks. Sylvia would just copy these investments with her own modest wages- and never sold them. .

What’s fascinating is that this was not an isolated incident. Is investing small amounts worth it? These stories would strongly suggest it is.

There was Leonard Gigowski, a Milwaukee bachelor and corner shop owner who left $13 million to a scholarship program or Donald and Mildred Othmer, who left $750 million behind when they died. There was also Grace Groner, a Chicago-based secretary who invested 180 dollars once in 1935 and died with $7 million in assets.

What do all these people share in common? Time.

Many people use Franklin’s saying as a way to express frustration with their time being wasted. Actually, the meaning is quite literal when it comes to investing. Time can literally equal money.

Risk warning: Any figures depicted are for illustration purposes only and other factors may affect any potential return on your investments. Past performance of any investment product is not a reliable indicator of future results.

Returns from a small investment over time

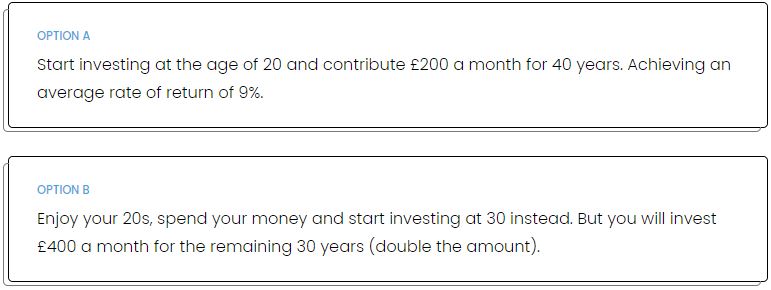

Quiz question: Which of the following would you choose? A or B?

You probably guessed this is a trick question but still the results are shocking.

£200 a month for 40 years delivers an end pot of £943 486.

£400 a month for 30 years gets you £738,189.

A massive difference of over £200,000.In fact, you would actually need to put away over £500 a month a year every year for thirty years to overtake the head start that the £24k you invested in your 20s gave you.This example is not made to make you feel sad about wasting your youth, it is meant to demonstrate the power of time - even when investing with smaller amounts of money.

Why people don’t invest (when they should)

The previous startling example and the stories of extremely frugal OAPs dying with million-dollar fortunes are simple examples of compounding interest at work that everyone should understand. But they don’t.The data shows that in 2018 only 12% of the UK population invested in the stock market, although that shot up to 33% amid the meme trading frenzy of 2021.The fact remains that most people don't invest, and the most commonly cited reasons are:

In the light of easy examples to demonstrate that investing small amounts is well worth it, where does the concept of it not being worth it come from?It likely comes down to fees. Commissions to traditional stock brokers and annual mutual fund management fees have historically been an expensive barrier to many would-be investors.What is the point of investing £20/30 a month when dealing fees would take up half of that?Fortunately, Trading 212 has removed that barrier, offering commission-free stock trading. Coupled with the ability to buy fractional shares, you can now literally invest with as little as £1 if you wish.The removal of these unnecessary fees has made it possible for anyone with any budget to get involved.