With all that has been going on recently – rising inflation, tension in eastern Europe, volatility in the stock market and the prospect of tightening monetary policy – some may have overlooked that we are right in the middle of earnings season.

This morning, Sony shares are up more than 4.8% in pre-market trading after releasing their quarterly results for the three months ending 31 December 2021, which significantly exceeded the market’s expectations.

Sony reported revenue of 3 trillion yen ($26.4 billion), against an expected 2.9 trillion yen ($25.46 billion), which represented an increase of 13% year-on-year (YOY). Operating profit for the quarter jumped an impressive 32% YOY, reaching 465.2 billion yen ($4.05 billion).

These better than expected results were largely thanks to a surge in earnings from its pictures unit, in which operating income increased more than 636% YOY, following the success of “Spider-Man: No Way Home”.

These positive results led to Sony revising their full-year profit forecast from 1.04 trillion yen up to 1.2 trillion yen.

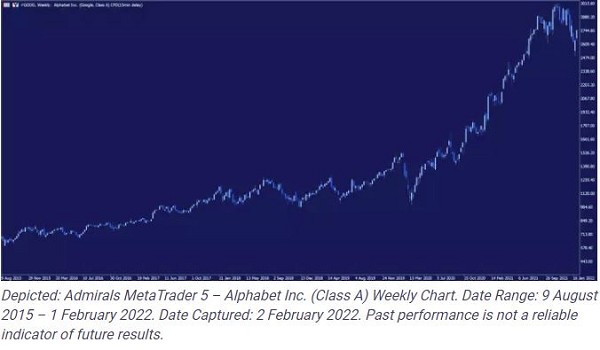

Another company performing well in pre-market trading this morning is technology giant Alphabet (parent company to Google), whose share price is up more than 10% off the back of their own positive results for the final quarter of 2021.

Alphabet reported total revenue of $75.3 billion for the quarter, a 32% increase YOY and significantly higher than the expected $72.2 billion. For the full-year 2021, revenue was reported as $257.6 billion, a 41% increase YOY.

Net income for the quarter increased 36% YOY to $20.6 billion and, for the full-year 2021, was reported at $76 billion, an incredible increase of 89% from the previous year.

These impressive figures were largely driven by Google and YouTube’s advertising businesses, which generated 92.7% of revenue in the fourth quarter, largely due to the pandemic, which has fuelled an increase in digital advertising.

Alphabet also announced that the company would undertake a twenty-for-one stock split on 15 July, subject to shareholder approval. In 2020, Apple and Tesla shares both soared following the news and implementation of their own respective stock splits.

One of the benefits of stock splits is that it makes expensive stocks more affordable to a larger pool of investors, which sometimes has the effect of increasing demand and, therefore, pushing up price. However, with the rising availability and popularity of fractional shares, it is possible that the tactic will not be quite as effective in this regard as it has been in the past.

By Financial Writer, Admirals, London