Today, at 12:00 GMT, the Bank of England (BoE) will announce their latest interest rate decision, shortly followed the European Central Bank (ECB) at 12:45.

Whilst the ECB is expected to leave policy unchanged for the time being, the BoE is widely anticipated to announce a rise in interest rates for the second time in as many months, following the previous hike at their last policy meeting in December.

Given the current high rate of inflation, 5.1% in the eurozone and 5.4% in the UK, there is a lot of focus on these central bank policy meetings. Traders should expect increased volatility in the markets around the announcement times, particularly if the outcomes are any different to what is expected.

Meanwhile, earnings season continues in earnest.

Unsurprisingly, given the increasing price of oil and gas, Shell (no longer Royal Dutch) reported strong fourth quarter results this morning, with profit at its highest level in eight years.

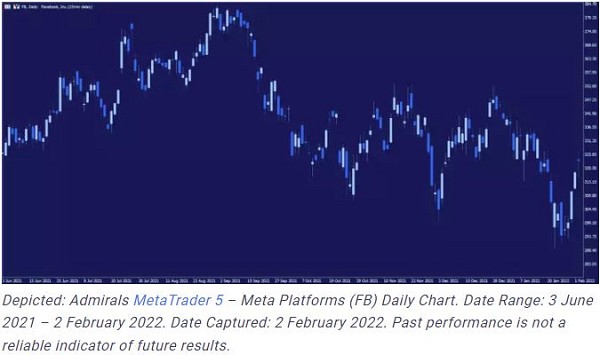

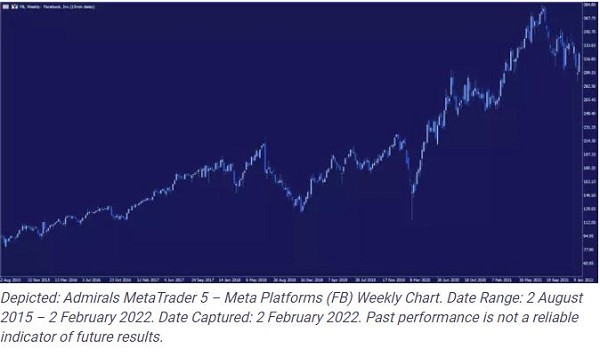

Elsewhere, after excellent results from Google-parent Alphabet on Tuesday, yesterday was the turn of Facebook owner Meta Platforms. Unlike Alphabet, Meta Platforms' quarterly results fell short and the social media company posted a poor forecast for the current quarter.

Meta Platform’s total revenue in Q4 grew 20% year-on-year (YOY) reaching $33.67 billion, exceeding the expected $33.34 billion. However, due to a large increase in total costs, earnings per share (EPS), which had been expected at $3.85, was reported as $3.67 per share, a decline of 5% YOY.

Moreover, for the first time, daily active users of Facebook declined from the previous quarter to 1.929 billion, down from 1.930 billion, whilst monthly active users remained the same.

For the current quarter, Meta Platforms forecast total revenue in the range of $27 billion - $29 billion, which was significantly lower than analysts’ expectations of $30.15 billion. Increased competition for users and Apple’s iOS privacy changes were cited as reasons for the weaker than expected forecast.

In response to this news, Meta Platforms share price fell a massive 20% in after-hours trading, erasing around $200 billion of its market capitalisation, and there were similar declines in other social media stocks. Twitter, Pinterest and Snap Inc are all down by around 6.5%, 7% and 14% respectively in pre-market trading.

This evening, the last of the FAANG stocks, Amazon, are due to release their results for the final quarter of 2021.

By Financial Writer, Admirals, London