Last week, on Thursday, Facebook owner Meta Platforms’ market capitalisation plunged $237 billion, the largest recorded single day loss for a US company.

This unwelcome record was set after Meta’s share price collapsed more than 26% following disappointing quarterly results and a weak forecast for the current quarter. Yesterday, the social media giant’s woes continued as share price fell by a further 5.14% during the session, closing at its lowest level since June 2020.

Enjoying a more positive day was exercise bike maker Peloton Interactive, whose share price soared almost 21% yesterday, amidst reports of takeover interest from Nike and Amazon.

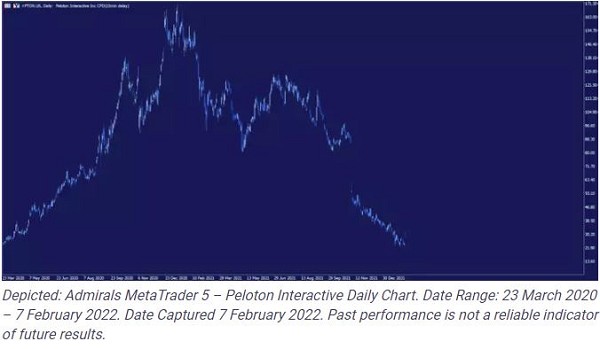

Peloton enjoyed a surge in popularity during the pandemic, becoming one of lockdown’s greatest success stories, as its bikes were snapped up by people stuck at home. This surge in popularity was reflected in its share price, which shot up more than 430% in 2020.

However, as gyms have reopened and rival products have entered the market, demand for the company’s products has faded, and with it its fortunes. Since closing at an all-time high in January 2021, share price has fallen more than 80%, pretty much wiping out all the gains recorded during the pandemic.

Although there has been no official response from any of the companies involved, there have been reports that both Nike and Amazon are considering separate bids for the exercise bike maker, and this was enough to spark interest from investors yesterday.

The takeover reports come just two weeks after activist investor Blackwells Capital expressed their desire for Peloton to fire their CEO and consider putting their business up for sale.

Peloton are due to report their quarterly results today after the market closes (21:00 GMT) and investors will be looking for any clues on whether the company are open to bidders.

By Financial Writer, Admirals, London