- Home

- Share Prices

- AQSE Share Prices

- Euronext

- Stock Screeners

- Share Chat

- FX

- News & RNS

- Events

- Media

- Trading Brokers

- Finance Tools

- Members

Latest Share Chat

Scrutinising investment trusts - The search for value continues, via Commercial Property

Monday, 24th April 2023 11:40 - by David Harbage

This blog is the final one in a series of four, searching for Value amongst close-ended investment trusts. It follows on from previous reviews of UK equity selections Henderson Opportunities (HOT), Lowland (LWI), Aberforth Smaller Companies (ASL) and Artemis Alpha (ATS) as well as deeply discounted private equity via Harbourvest Global Private Equity (HVPE), Oakley Capital (OCI) and Pantheon International (PIN).

A search for value amongst investment trusts – chosen in preference over open-ended funds, (whose fund managers may become forced sellers of their portfolio’s assets in the face of overwhelming selling from unit holders) – has featured neglected trusts whose share prices are lagging the valuation of their assets. There may be good reason to be negative about the immediate prospects, but the astute investor may have their own view on the outcome and, contrarily or opportunistically, decide to purchase. Buying an out-of-favour trust’s shares - on say a discount of 20% to asset worth - could produce a beneficially geared return: if the asset value rises by 20% and the discount ‘tightens’ to 10% (as investors take a more favourable view of the trust’s assets); the trust’s share price could then rise by 30%, comfortably outperforming the asset.

- Scrutinising investment trusts -The search for value continues, via Private Equity

- Markets are Volatile but don't let it be Emotional

- Value Investment trusts – A 'look under the bonnet'

Investment trusts are companies in their own right, listed on the London or other recognised stock exchange, and their share prices will (like any individual company stock) reflect the appetite of buyers and sellers. At any given point in time, certain sectors of investment have enjoyed positive momentum – leading investment trusts who specialise in those asset types to perform well, perhaps even seeing share prices exceed the underlying assets’ worth. By contrast, when a particular class of investment is out of favour the share price of investment trusts which specialise in that kind of asset will find itself unloved, and the gap or ‘discount’ between the trust’s share price and the value of its net assets (NAV) will increase.

Smart investors will take the appropriate longer term view (of at least five, if not ten, years) when deciding which assets – and in what proportion - to own. They will also consider the discount at which a trust’s share price has historically traded - as compared to its asset worth – before deciding if the current price (assessed against NAV) is fair, under or overvalued. The DIY investor can search online to learn more about each trust’s objective, guidelines, individual style, strategy, risk controls, perspective on the economy or its particular specialism, rationale for the larger constituents and recent transactional activity. In the first instance, consider visiting the company’s own website (perhaps to view video interviews with the fund managers), before turning to the London Stock Exchange’s regulatory news service (RNS) as well as other sources for independent commentaries and opinions.

In this final commentary on trusts perceived as offering Value – something one might expect DIY investors to be seeking, given that a number of developed equity markets are close to their peaks (including the FTSE 100 nudging up towards 8,000) - we are focusing on UK commercial property. Since interest rates started to rise last year, and in particular when medium term government bond yields spiked some six months ago, assets viewed as closely co-related or sensitive to interest rates have come under selling pressure. The likes of infrastructure and property funds, which undertake major construction projects, have typically used debt (bank and other borrowing arrangements) to fund land purchases and build costs. Encouraged by near zero % rates to adopt high financial gearing, the expense of servicing such debt will have increased dramatically, cutting into profitability and even resulting in foreclosure or asset disposals to shore up a balance sheet.

Investors will often apply indiscriminate ‘across the board’ action upon learning of adverse news, or change in a trend, often based on historic experience. For example UK house builders’ shares halved in value in the first nine months of 2022 as Bank and mortgage rates steadily rose – mindful that over previous decades, listed and private builders have struggled to remain solvent in what is undoubtedly a cyclical industry. While not as sensitive to the consumer, commercial property development will share in this possible ‘boom-bust’ scenario and in 2022 investors reduced exposure to this sector too.

Closer consideration of the individual businesses’ financial health and trading prospects might yet mean that a less ‘knee jerk’ approach is appropriate. For instance, while not wholly homogenous, most of the larger house builders listed on the London Stock Exchange – having learnt from the previous downturn in 2007/08 – can boast net cash (rather than debt, before consideration of their land purchase options) on their balance sheets. Over the past nine months, the share prices of leading new home builders such as Barratt Developments (BDEV), Bellway (BWY), Berkeley Group (BKG), Redrow (RDW) and Taylor Wimpey (TW.) have bounced back – some by more than 50% - as a ‘bottom-up’ perspective provided comfort that they can comfortably survive a downturn in the domestic economy. And it is noted that recovery in these stock prices has come about, despite medium term bond yields having risen a little over the past month.

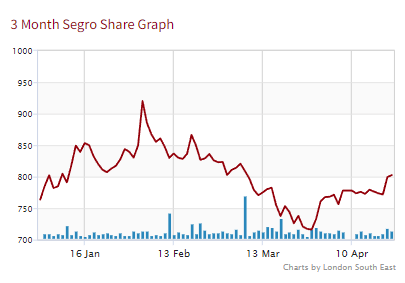

The UK’s biggest listed commercial property companies carry more debt than the builders as these landlords are more focused on collecting rent (as opposed to development), while also managing their portfolio of industrial, office and retail assets, alongside some development and building activity. The share prices of British Land (BLND), Land Securities (LAND) and Segro (SGRO) ( fell in very similar fashion to the house builders (halving in some instances) last year but, despite a 10% rise in the past month – driven by trading updates beating analysts’ forecasts (featuring high occupancy and rent receipts) – the share prices of these industry leaders still have a long way to go before reaching the level prevailing at the beginning of 2022. Sell-side brokers remain wary of the sector, evidenced by their research houses’ opinions on the UK’s biggest listed company, Segro. At the point of writing this, 12 analysts say Buy, 7 are neutral and 4 have a Sell recommendation; three months ago there were 15 Buys, 5 Holds and 3 Sell opinions, and 6 months ago the consensus was more positive again with only 1 sell recommendation on the FTSE 100 REIT’s shares.

The leader in UK industrial and warehouse segment, Segro pleased the market with an upbeat trading update last week (its shares rose 27p on the day, to 799p). Owning properties valued at £20.9bn as at 31 December 2022 - net asset value (NAV) per share is 938p - the group has £5.9bn of net debt, equating to a loan to value (LTV) ratio of 33%. In terms of the business’ comfort level in servicing those borrowings, Segro’s has occupancy at 95.7% within its properties, customer retention is 82% and boasted a high number of uplifts on rental reviews in the first quarter of 2023. Turning to the debt itself: 92% is at fixed or capped rates and the overall cost of its debt (which has an average maturity of 8.2 years) has risen from 2.5% to 2.7% over the past year.

Looking beyond this example of a successful commercial property company, whose shares are currently priced at a 15% discount to their asset worth and, via a 26.3p dividend, offer an income yield of 3.3%, one could view the whole listed real estate sector as representing a reasonably attractive Value investment. Offering an overall discount of 28% to asset worth and an income yield of 3.7% (which is more appealing than the overall UK equity market’s price to book value (PB) and income pay-out), owning an exchange traded fund (ETF) – such as i shares UK Property ETF (IUKP) – is worthy of consideration. However, because this represents an investment in company shares (as well as in the underlying properties), the ETF would be affected by overall sentiment towards the stock market so, to overcome this, we will turn our attention to investment trusts who invest direct into commercial property.

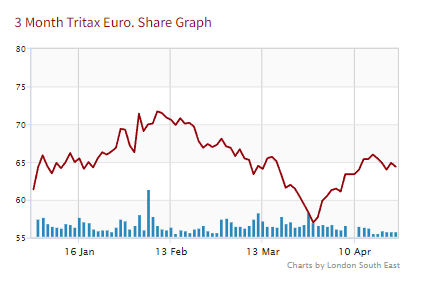

As their titles suggests the closed-ended trusts Tritax Big Box (BBOX) and Tritax Eurobox (EBOX) specialise in big warehouses in either the UK or continental Europe – rather like LSE listed Segro – owning total assets of £4.9bn and £1.5bn respectively. Their properties tend to be large, modern, have high ESG credentials, possess long leases (with inflation linked rent uplifts) and are located edge or out-of-town, with large food or general retailers dominating the tenants list. Benefitting from the online retail trend, occupancy level is exceptionally high (almost a nil vacancy rate) and, although having a pipeline of development opportunities (primarily pre-let, rather than speculative), their loan to value ratio is not high: 23% BBOX and in the case of 28% EBOX.

The shares of both came under pressure when interest rates rose last year - having previously been seen as the segment of commercial property enjoying highest demand (performing particularly well during the outbreak of Covid). In the case of BBOX, the stock price lost its longstanding premium to NAV a year ago and is currently priced at a 23% discount to underlying asset worth; with its quarterly dividends equating to an income yield of 4.7%. EBOX is seemingly more undervalued, with its shares at a 44% discount to NAV and offering an income yield of 6.6%.

- View our Investment Trust page for the latest news and analysis

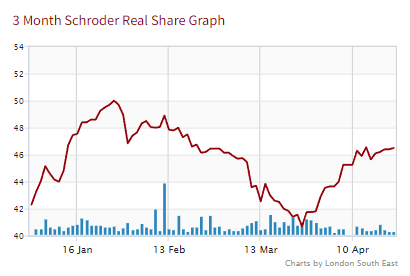

Looking beyond the big warehouse segment to commercial property more generally, prospective investors might wish to take a look at the following two property trusts: abrdn Property Income (API) and Schroder Real Estate investment trust (SREI). Both aim to provide an attractive level of income, with the potential for income and capital growth, by investing in UK commercial property. In addition they seek to reduce risk and progress diversification – for example by providing guidelines on the level of debt that they will carry (as a proportion of assets), along with restrictions on the value of any one property or tenant (relative to total asset worth or rent roll). Their costs are similar, by reference to last year’s on-going charges (calculated by comparing expenses to total assets) - being SREI’s 1.99% and API’s 2.1% per annum.

The latest updates from the trusts show how the two, similarly sized (API £431m, SREI £469m of assets), high occupancy level, real estate portfolios are currently positioned:

abrdn Property Income – 49 properties, in terms of type, industrial & warehouse 57%, office 24%, retail 12%, other (leisure, hotels, student accommodation etc) 7%; geographically Midlands 33%, South-east 28%, North 19%, Scotland 10%, South-west 5% and London 5%.

Schroder Real Estate – 42 properties split between industrial & warehouse 58%, office 28%, retail 3%, other 11%; and in geographic terms North & Scotland 42%, Midlands & Wales 21%, South-east 19%, South 10% and London 8%.

Based on their current share prices and last year’s quarterly income distributions, API stands at a 35% discount to its underlying asset worth of 84p and produces an income yield of 7.2%, while SREI’s market value is closer to its NAV of 62p (a 22% discount) and yields 6.5%.

Finally, as something of a special situation, the author would highlight real estate investment trust (REIT) and FTSE 250 constituent UK Commercial Property (UKCM); like API, the assets are managed by fund manager abrdn. It has a larger portfolio of 49 properties, worth £1.3bn (meaning that the individual average worth is twice that of API and SREI) and a lower financial gearing (LTV is 20%, 68% of the debt is a fixed rates and the blended interest cost is 3.6%). Occupancy is 98% and EPRA earnings (core operating earnings, excluding gains on disposals) rose 19% last year In terms of property type, industrial & warehouse accounts for 74%, office 14%, retail 2%, and other (leisure, hotels, student accommodation etc) 12%; geographically the assets are located in the South-east 36%, Midlands 23%, London 16%, North 10%, South-west 8% and Scotland 7%.

Based on its share price as at the time of writing, and quarterly dividend track record, UKCM stands at a 36% discount to its 80p asset worth and offers an income yield of 6.5%. Interestingly, the company has a policy to control the extent to which the share price can adversely deviate from its asset worth: “if the market price is more than 5% below NAV for a continuous period of 90 dealing days or more, following the second anniversary of the company’s most recent continuation vote in relation to the discount control policy, the directors will convene an extraordinary general meeting to be held within three months to consider an ordinary resolution for the continuation of the company. While UKCM has a major institutional investor, Phoenix (owning 43.4% of the equity), which has expressed confidence in the longer term prospects for the trust, the possibility of seeing value emerge via a winding up or disposal of the assets - to reduce or remove the discount - exists."

The move on 3 April by the US private asset giant Blackstone to bid for the £490m market capitalised UK listed Industrials REIT (MLI) produced a 41% increase in the latter’s share price – which had previously been languishing on a double-digit discount to its NAV. Further consolidation within the sector is likely, with US buyers particularly opportunistic (this is the fourth real estate purchase made by Blackstone in the past four years). By contrast with America, where property vacancies of up to 20% apply in many of its cities, the UK will probably always have a scarcity of land issue – given the excess demand (growing population or smaller family units) versus limited supply. This is something that can underpin both the builders of new homes (for purchase or, via partnerships, rent), as well as the owners of various commercial property (as, intuitively, the capital value of an asset that produces rising rental income should appreciate).

While the prospect of creating a portfolio of ETFs – to track different asset types, at low cost – has its appeal, the investor with a keen interest in stock market or other investment, and who possesses the necessary longer term time horizon, may wish to investigate investment trusts in search of additional returns. If this is the case, the writer hopes that this series of articles on Value has whetted the reader’s appetite.

The Writer's views are their own, not a representation of London South East's. No advice is inferred or given. If you require financial advice, please seek an Independent Financial Adviser.