- Home

- Share Prices

- AQSE Share Prices

- Euronext

- Stock Screeners

- Share Chat

- FX

- News & RNS

- Events

- Media

- Trading Brokers

- Finance Tools

- Members

Latest Share Chat

Scrutinising investment trusts - The search for value continues, via Private Equity

Thursday, 20th April 2023 10:44 - by David Harbage

This blog is the third in a series of four which is searching for Value amongst close-ended investment trusts, following on from the previous reviews of Henderson Opportunities (HOT), Lowland (LWI), Aberforth Smaller Companies (ASL) and Artemis Alpha (ATS). The DIY investor can search online and discover more – via a company’s own website, the London Stock Exchange’s regulatory news service (RNS), video interviews with the fund managers and independent articles – in particular about each trust’s objectives, guidelines, individual style, strategy, risk controls, perspective on the economy or particular market, rationale for the largest constituents and recent transactional activity.

- Markets are Volatile but don't let it be Emotional

- Value Investment trusts – A 'look under the bonnet'

Moving away from company shares listed on recognised stock exchanges, this article take a look at unquoted or private equity. Beyond family businesses of varying size, some of the world’s largest companies fall into this category, including American giants Bechtel (construction), Mars (confectionery & petcare) and financial institutions Deloitte, Fidelity Investments and PricewaterhouseCoopers. But, the reader might ask, why invest in such businesses – if indeed one could - when there are thousands of firms who are more obviously in the public eye and are priced or traded on a daily basis. The simple answer is that historically the performance of private equity has been impressive, often exceeding returns produced by leading index measures of the world’s developed stock markets.

Certainly, the benefit of being a private company can also be its prime disadvantage: without having to provide updates on any ‘market sensitive information (via RNS statements) and respond to limitless investor questions, management are better able to concentrate on managing the business. The downside of the less transparent nature of unquoted equity is the absence of daily trading – and therefore reliable valuation – with investors having to rely on monthly or quarterly ‘best endeavour’ assessments of a private firm’s worth. These are typically carried out by independent valuers applying listed industry peer comparators (using revenue or profit metrics), as well as other relevant commercial information (such as property transaction valuations), to calculate asset worth.

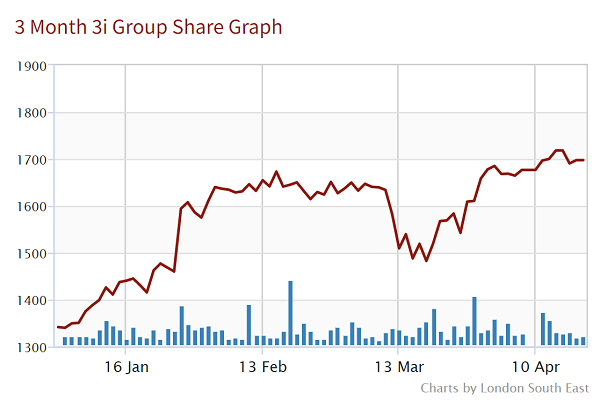

In this article we will look at opportunities in private equity which extend beyond an individual company to the owners or managers of many unquoted businesses. Best known in the UK would probably be the high profile, venture capitalist 3i (III) which owns a stake in 475 investments and 333 companies but, although possessing a portfolio worth more than £16bn, few personal investors would know much about its underlying business interests. Its largest holding is a 52.7% stake, worth £10bn, in Benelux-based Action which is Europe’s largest non-food discount retailer. 3i paid just £134m when first taking a 45% stake in Action in 2011 and now receives an annual dividend in excess of that sum from its investment; subsequently rising 65-fold to currently represent 60% of the venture capitalist’s total portfolio worth. The FTSE 100 constituent can boast an impressive track record of both asset appreciation and share price growth – the latter has delivered average annual total (capital, plus income) returns of 35% and 17.6% over the past three and five years to date respectively. However, after advancing 15% in the past month and 27% in 2023 to date, 3i shares currently appear very fully valued - on a 4.5% premium to their net underlying assets’ worth, which compares to a 10% discount to NAV over the past twelve months - with too much dependence on one company for this writer’s liking. Any disappointment in Action’s trading performance would adversely impact 3i’s share price.

Incidentally, this industry has sometimes received a ‘bad press’ notably when acquiring distressed firms - featuring those making losses or possessing weak balance sheets, and which were likely to go bankrupt – before ‘stripping the assets’, removing costs (which might be much of the labour force, hence the disreputable media headlines) and selling the remnant. However, more typically, managers of private equity identify and take a stake in successful family businesses which lack the management expertise (akin to a Dragons Den investment) or scale to capture the potential growth opportunity.

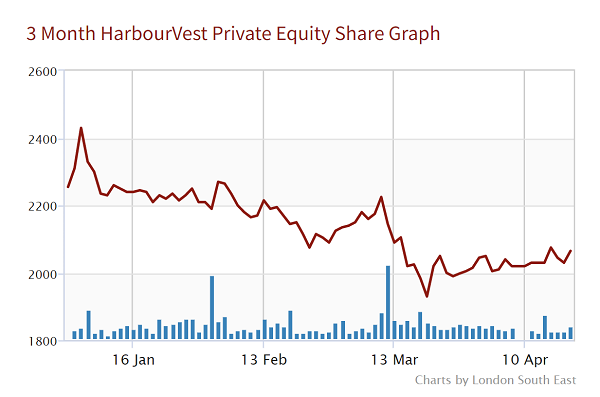

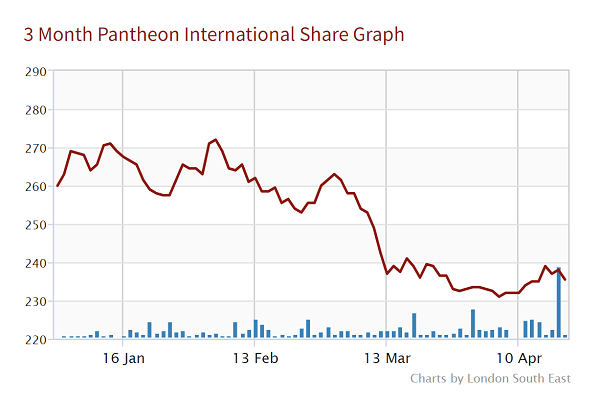

Without personal recommendation, here are the factors that prompt this blog’s mention (and, on occasion, the writer’s ownership) of two actively managed investment vehicles, Harbourvest Global Private Equity (HVPE) and Pantheon International (PIN), which the investment trust industry’s body (the Association of Investment Companies, or AIC) classify as Private Equity Fund of Funds. In addition, a further AIC classification – termed Private Equity Direct – features twelve trusts including Oakley Capital (OCI) which, as the descriptor indicates, invests into a limited number of individual unlisted companies.

Harbourvest Global Private Equity and Pantheon International would describe themselves as “existing to provide easy access to a diversified global portfolio of high quality private companies via their partner funds” – essentially providing an opportunity which would otherwise only be available to institutional or very high net worth investors. Both follow similar paths in selecting investments, seeking a balanced mix of different stages (from seed money to mature), strategies (primary, secondary and via co-investment fund investments), as well as in geographical terms – mindful that further financial commitment will be required along the pathway of what is likely to be a 5-10 year business plan.

For instance, HVPE currently categorises its underlying portfolio of private investments as being: 56% Buy-outs, 36% Venture & Growth equity and 8% Mezzanine, Infrastructure & Real assets; 53% Primary, 28% Secondary and 19% Direct Co-investment; 63% North America, 20% Europe, 14% Asia Pacific and 3% rest of world. HVPE management make ‘top-down’ allocation decisions on the beneficially appropriate mix of these asset types, as well as engaging in the ‘bottom up’ selection of 1,000+ private companies. As regards the latter, HVPE’s two largest investments are a US$85m exposure to Shein a global Business to Consumer (B2C) firm providing one of the world’s largest women’s fast fashion goods e-commerce platform and a A$30m position in DP World Australia which operates marine terminals and cargo services throughout Australia.

Turning to PIN, similar diversification strategies apply to their portfolio of unquoted assets: 44% are small/mid-sized Buyouts, 26% large/mega Buyouts, 20% Growth, 6% Special situations and 4% venture capital; 33% are Primary, 33% Secondary and 34% Co-investments; based 55% in the United States, 28% Europe, 10% Asia & Emerging Markets and 7% Global. A look at the maturity (or length of tenure) of their investments show broad dispersion (including an intuitive slowdown during the first year of Covid): 27% since 2021, 7% in 2020, 12% 2019, 13% 2018, 12% 2017, followed by single digit % annual weightings dating back pre 2010. PIN’s company sectors reveal a bias towards growth business activities: 34% Information Technology, 19% Healthcare, 13% Consumer, 11% Financials, 10% Industrials, 7% Communication Services, 3% Energy, 2% Materials and 1% any other segment. As an example of previously mentioned Co-investments, PIN has had an 18 year relationship with another private equity manager HG Capital and one of its joint enterprises is a £14m exposure to unlisted IT firm Access Group whose 5,000 employees provide business management software to 60,000 organisations in the UK.

By contrast with the highly diversified HVPE and PIN which can proffer 40+ years’ experience in private company investment, typically via funds, Oakley Capital (OCI) has taken direct stakes in unlisted businesses for the past two decades. Its growth focused strategies centre on buy-out opportunities in the mid and lower market space. A pan-European investor with offices in London, Milan and Munich, OCI seeks to “become the ideal partner for ambitious founders and management teams of outstanding mid-market size businesses in three business sectors: technology, consumer and education”. Often the first institutional investor - as their origination strategy seeks businesses outside of the mainstream auction process - the managers have an entrepreneurial heritage and have a successful track record of procuring partnerships via bespoke innovative deals.

The portfolio is concentrated: 7 Technology investments including three each worth £60m+ (WebPros, Grupo Primavera and Contabo), 11 in the Consumer sector including £139m in North Sails and £33m in publisher Time Out, and 6 in Education. An example of OCI’s investments is a majority stake (currently worth circa £200m) in IU Group, the fastest university group in Germany with 40 campuses, over 100,000 students (of which 70% come from non-academic households). A digital education business, courses are often delivered online and geographic expansion (includes the prospect of 100,000 scholarships across Africa) could make this the world’s fastest growing, if not largest, higher education college. Closer to home, this week OCI has announced a partnership with a family run group of independent co-educational schools - Thomas’ London Day Schools – making an initial £14m contribution.

In March, Oakley reported final results for calendar 2022 which showed that net asset value had risen 24% to 662p per share, as earnings before interest tax depreciation and amortisation (EBITDA) rose 65%. Its portfolio currently is valued on an appealingly low price/earnings to earnings growth (PEG) multiple of 0.7 times and £244m of disposals or exits were effected at an average price 70% ahead of their estimated worth (carrying or book value). Despite the company having delivered the best five year share price return of (+200%) of its AIC peers and comfortably outperforming its FTSE All-Share index benchmark, OCI equity currently languishes on a 32% discount to NAV. With a market capitalisation of £794m (close to becoming FTSE 250 size), the shares are not illiquid and, aided by an active repurchase scheme and a progressive dividend policy, the prospect of further asset appreciation and a tightening discount could provide a positive ‘double whammy’ over the medium term.

- Visit our Investment Trust page for news and analysis

With respective market capitalisations of £1.6bn and £1.25bn, FTSE 250 constituents Harbourvest Global and Pantheon are significantly larger and, by reference to their ‘fund of funds’ approach, represent lower risk-reward investments than OCI. Measured against their respective FTSE All World and MSCI index benchmarks, track records for both trusts have been impressive: in its latest set of results to the 31 July 2022, HVPE produced increases of 8%, 85%, 139% and 319% in its US dollar denominated NAV over 1, 3, 5 and 10 years respectively. Over the same time periods, the £ based share price rose by 7%, 40%, 90% and 426%. The performance of PIN’s assets was similarly impressive: annualised returns of the trust’s NAV in the period to 28 February 2023: was 11%, 16.8%, 15.6% and 13.5% over 1, 3, 5 and 10 years. This also represented comfortable outperformance of the MSCI World and FTSE All Share total return indices and, importantly, is net of costs – that is these numbers take account of the inherent expense (usually higher than the management fees charged by listed equity trusts, often involving performance-related fees) within private equity investment management.

However, as with OCI, this segment of risk asset has been neglected by investors – both institutional and private clients - over the past three years. Much of this can be attributed to a ‘risk-off’ attitude, as uncertainties emanating from the Covid pandemic and the Russian invasion of Ukraine, reduced corporate activity as well as investor appetite for non-income producing assets. However, the past month’s £9bn+ merger & acquisition activity in the UK – both rumoured (7 Investment Management within Caledonia trust’s portfolio of private equity) and actual (think Dechra Pharmaceuticals (DPH), Hyve (HYVE), Industrials REIT Network International (NETW), THG (THG) and John Wood Group (WG.) – might indicate a sea change.

That HVPE and PIN are deeply unloved is reflected in the current chasm between their share prices and the latest 28 February 2023 asset valuations – HVPE’s share price is currently 2025p a 50% discount to the £40.50p NAV, while the market is currently pricing PIN’s equity in similar fashion, at 234p compared to the trust’s 463p NAV. Interestingly, the previous blog highlighted Aberforth Smaller Companies trust (ASL) and Artemis Alpha trust (ATS) – both being owners of a portfolio of listed UK equity which has Value as its prime attribute, and capable of benefitting from predatory action from managers of private equity who typically have a focus on Growth when selecting company investments. By owning a combination of the likes of ASL, ATS, HVPE, OCI and PIN, investors can gain exposure to businesses exhibiting both Growth & Value - or achieve ‘Growth at reasonable price’ (GARP).

Although the opaque nature of company investments not listed and reporting via a well-regulated stock exchange is something of an inhibiting factor, prospective investors can learn a lot about the recent history of these managers - as well as their current company investments. It is also true that the managers of private equity investments (who are often amongst the best in the wider asset management industry), reward themselves very handsomely. However they are also major stakeholders (for example directors, partners and staff at OCI account for 13% of the equity) and possessing ‘skin in the game’ makes eminent sense to most of us and provides further comfort to the wary investor.

A final commentary on trusts perceived as offering Value – something DIY investors may be seeking, given that a number of developed equity markets are close to their peaks (including the FTSE 100 nudging up towards 8,000 again) – featuring commercial property, amongst other assets, will follow shortly.

The Writer's views are their own, not a representation of London South East's. No advice is inferred or given. If you require financial advice, please seek an Independent Financial Adviser.