Gold moved upwards for the past three consecutive weeks making the case for an attempt to higher grounds. Gold has now partially recovered from the major drop its price undertook in June after a surprise hawkish stance by the FED. This week ahead seems interesting for Gold traders and some upcoming events can create the right circumstances for setups to be created. After our fundamental analysis, we will also provide a technical analysis in which we will identify important levels or trends that could prove useful to traders.

One of the most obvious reasons supporting the recent move higher for Gold was the bond market activity that is closely related to the precious metal’s price. In the past week, 10 Year US Treasury yields plunged as low as 1.25% forcing traders to shift money to the Gold market sustaining the adverse relationship the two instruments tend to keep. Bond Yields had peaked in the past March, yet the extensive stimulus packages by the US government and the conservative stance investors and consumers have kept in the past months may have led to a dramatic turn to the stock markets that have been breaking all time high levels on a consecutive basis. According to a report by the Financial Times the 10-Year US Treasury yield is expected to remain lower.

On a different note the FOMC meeting minutes that took place in the previous week may have also contributed to some buying flows for Gold. Price action upon release of the Minutes was minimum, yet the outcome of the meeting is important for the future. It was understood that the Fed could be ready to cut down on its bond buying program sooner than later. The news created an initial and perhaps emotional down fall for the greenback pushing Gold prices slightly higher. According to the Dollar Index the strength of the greenback was muted after the event took place ending the week on the low. Gold and the greenback did not keep 100% negative correlation in the previous days as they usually do. Yet some events tend to display this kind of relationship more than others. Thus, we would expect the USD to continue to have an adverse relationship to Gold in the following days, as an interesting economic calendar unfolds which can produce significant volatility for Gold’s price. First of all, substantial attention is expected to shift to Fed Chairman Jerome Powell’s testimony before Congress on Wednesday the 14th and Thursday the 15th of July, who testifies on the Semiannual Monetary Policy Report to Congress. As a closure we leave room for some Gold traders to abandon positions and move money into the stock markets in the next half of July as the earnings season returns and could be more enticing for traders in terms of returns at this point.

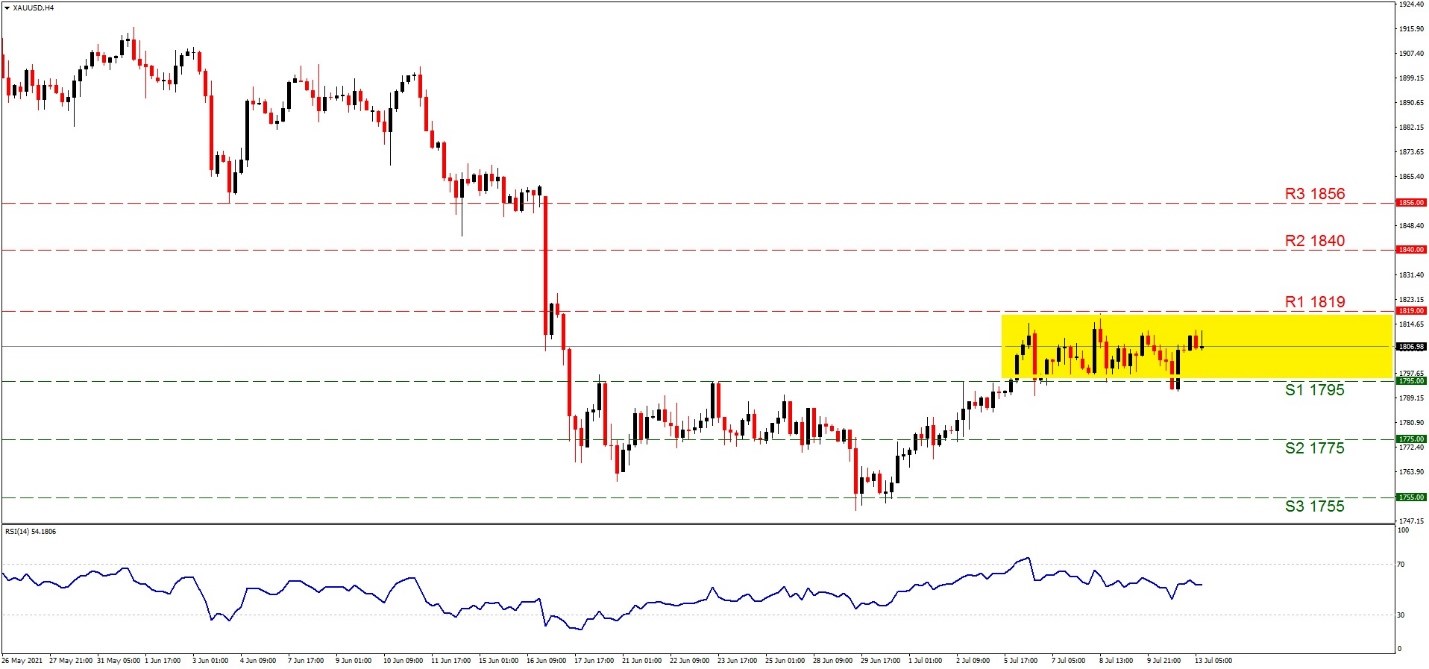

XAU/USD H4 Chart

Gold is currently locked in the range between our (R1) 1819 resistance level and our (S1) 1795 support level which is highlighted in yellow in our chart. Please note the (R1) is the highest price reached so far in July for Gold while the lowest point reached is currently noted as the (S3) 1755 line which is equally important. The RSI indicator below our chart is currently running above the 50 level imply the bulls are still in charge. To fully dominate, the bulls will have to push prices to the (R2) 1840 line or even higher to the (R3) 1856 level which will also act as a continuation of the upward trend formed since the start of July. On the contrary a sudden drop could possibly send Gold to the (S2) 1775 level which was a notable support line back in June. Our personal view, which is based on the fundamentals pre mentioned, enables us to keep a bullish bias for the precious metal. Yet the sideways motion in the short term is very characteristic at the moment.

This information is not considered as investment advice or an investment recommendation, but instead a marketing communication. IronFX is not responsible for any data or information provided by third parties referenced, or hyperlinked, in this communication.