- Home

- Share Prices

- AQSE Share Prices

- Euronext

- Stock Screeners

- Share Chat

- FX

- News & RNS

- Events

- Media

- Trading Brokers

- Finance Tools

- Members

Latest Share Chat

Are you Riding the Tiger's Tail?

Friday, 6th August 2021 09:59 - by Andrew Craig

Regular readers of these articles will be aware of an ongoing and oft-repeated theme of mine: Namely that, to a certain degree at least, you can run your financial affairs so that you shouldn’t need to worry overly about stock market crashes (or crashes in financial markets more generally). As I’ve said on more than one occasion in the past:

“I believe that I can arrange my financial affairs such that I am comfortable that whether there is a massive crash or whether stock markets power ahead, my ability to meet my long-run financial goals will be largely unaffected. You should feel the same way too…”

Believing you can succeed with investment essentially regardless of what financial markets do is actually far more important than most people realise – for the simple reason that, if you do feel that way, you are very likely to actually invest.

I’ve said it before and I will say it again – there is plenty of evidence to support the contention that the number one reason that wealthy people are wealthy is that they are financially literate. They understand financial products and make use of them. Put another way - they are investors.

The National Endowment for Financial Education has found that 70% of lottery winners are bankrupt within seven years of their win. At the same time, Dr. Thomas J. Stanley has shown in his best-selling book “The Millionaire Next Door” that the vast majority of America’s millionaires are actually normal people on normal incomes who become wealthy with the gradual and diligent application of pretty simple investment rules – generally applied to property and stock markets.

Being (or indeed becoming) wealthy, then, is far more about learning about finance and investment and applying that knowledge than it is about having a massively high income or being born with a silver spoon. Interestingly – in the same way that 70% of lottery winners go bankrupt, a survey by the Williams Group wealth consultancy in the US has found that 70% of wealthy families lose their wealth by the second generation and 90% by the third. Being wealthy is truly all about financial literacy, regardless of whether you start with nothing or with a billion pounds.

Three keys to investment success

So how can you be a confident investor such that you maximise your chances of becoming wealthy over time? I would argue there are three reasonably simple components:

First, you make sure that you own all main asset classes from all main geographical regions – as you will hopefully know by now that we call this ‘owning the world’.

Secondly, you save and invest at least 10% of everything you earn in whichever time period you are paid, always, without fail. For most people this means saving and (ideally) then investing 10% of their monthly salary every month. This sort of monthly investment, imposes discipline and has the additional benefit of smoothing the price at which you are buying investment products. Regular readers should very likely be reasonably familiar with both of these ideas by now.

The subject of today’s article, however, is a third component. This is something which I have mentioned in recent articles but have not written on in any detail until now: The use of an investment technique called trend following.

Trend following – what is it?

So what is trend following and why do I believe it is important enough to consider as our third fundamental investment idea.

To explain:

Looking at financial data as far back as practicably possible and across essentially all financial markets, academic research and real experience has shown that the positive or negative direction of any market is statistically more likely to continue than to reverse.

This may seem a little strange but is actually a simple function of human nature. If a share or market has been going up steadily then, all other things being equal, there is a good chance it will continue to do so, if only because of the herd mentality of human beings. This is a well-known and reasonably well understood psychological phenomenon and has been driving boom and bust cycles for centuries.

As a result of this reality - over a long period of time, academics looking at financial markets have worked out a number of methods for predicting where prices in a market will likely go based on where they have come from. This broad approach to investment is known as “technical analysis”. Such analysis generates strict rules which help investors buy and sell with a higher probability of success.

None of these approaches are 100% accurate, but when applied with discipline, they can significantly improve investment returns, particularly when compared to the majority of “actively” managed funds – that is to say, funds where “clever” (and highly paid) investment professionals attempt to use their “skill” to choose when and what to buy and sell. After accounting for costs, studies consistently show that over a meaningful time period, as many as 90% of such active funds fail to outperform the market.

Reducing risk, improving returns

Arguably one of the most effective of these “technical” approaches to investment is “trend following”. Trend following simply takes a current (or recent average) price of an asset and compares it to a historical average price. If the current (or recent average) price is above the chosen historical average price then the investor remains invested in that asset. If the current price is found to be below the relevant historical average, then the investor sells out of the asset and switches those funds into cash (or something else suitably conservative / defensive).

As an example, the methodology might be to take the price that a stock market (or any other market for that matter) closed at yesterday and compare it to the average price that same stock market has closed at over the last 50, 100 or 200 trading days. Or it might take the average price the stock market has closed at for the last 20 trading days and compare it to the average price over the last 200 days.

Some longer term strategies even compare the average price over the last 30 weeks vs. the last 50 weeks and some incredibly short-term currency traders might even compare the last ten minutes against the previous hour, for example. There is no hard and fast rule and many different methods can work.

The important idea here is that if an asset’s price starts falling, at a certain point you will switch out of that asset and into cash. The level at which you might decide to do this will be based on a pre-determined, strict, disciplined and consistent process. Equally, when the price of that asset starts to rise again, you would switch out of cash and back into the asset in question based on the same process.

This methodology is proven in practice and tested over two hundred years with numerous different assets across many regions of the world and has a very significant effect on protecting against big falls in all such markets.

Evidence – in stock markets

It isn’t difficult to show just how powerful trend following is given the evidence of history across many markets in many regions of the world. Below are some charts to illustrate the point.

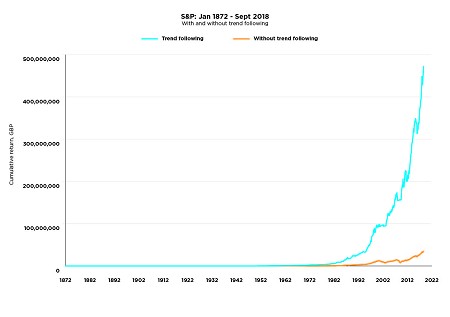

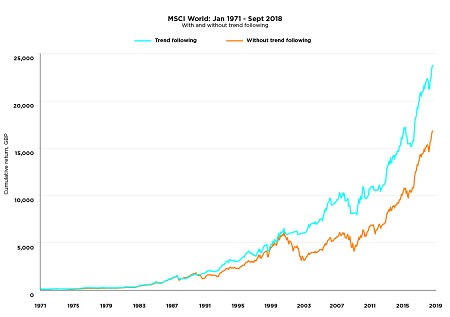

The first chart shows just how powerful an impact basic trend following has had over the very long-term in the US stock market. The second, shows the same for world stock markets as a whole since 1971. Please take a moment to consider the numbers in the pull-out boxes. For example - over 145 years, the use of simple trend following in American stock market investment has improved annual performance by more than 2% a year, reduced volatility by over 4% and the maximum draw-down from 81.76% to 47.40%!

This has had a huge impact – increasing performance whilst simultaneously reducing risk and volatility by this magnitude is transformational for building your wealth.

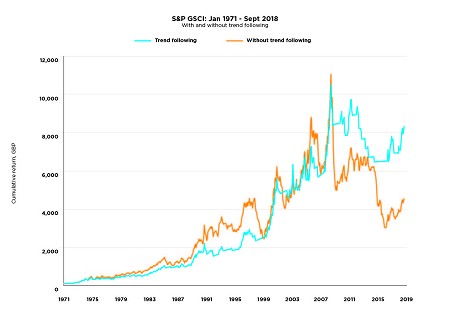

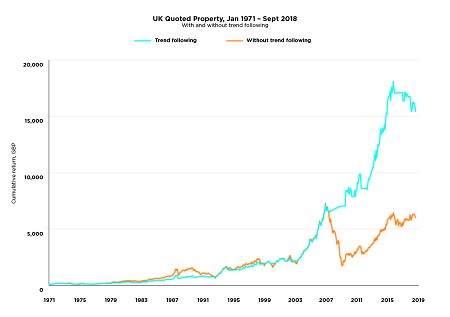

Amazingly enough, trend following is similarly effective when used in other asset classes. The two charts below show the significant improvements in returns and reduction in volatility and draw-down by using trend following in both the commodities and the property markets.

These charts and the performance and volatility numbers behind them, show us how extraordinarily powerful a tool trend following is for investment across the board.

Source: Professor Andrew Clare and Professor Stephen Thomas, Cass Business School.

Don’t just take my word for it

As you may have noticed from the “source” note immediately above, the evidence I’ve presented for trend following in this article has come from two high profile finance academics at the Cass Business School in London who have been kind enough to provide their time and input to produce the graphs above for us.

Why should we listen to them? Well...

Andrew Clare is Professor of Asset Management at Cass. Prior to that, he was a Senior Research Manager at the Bank of England and the lead Financial Economist for Legal & General Investment Management. Andrew has co-authored “The Trustee Guide to Investment” and, in a survey published in 2007 was ranked as the world’s ninth most prolific finance author of the past fifty years. Andrew serves on the investment committees of pension plans with assets totalling in excess of £7 billion.

Professor Steve Thomas, also of Cass, is a member of the editorial board of the Journal of Business Finance and Accounting and in a recent review was ranked 11th in Europe for finance research. Steve has had director experience at a leading global macro hedge fund and since 1988 has been consulting editor of a range of credit publications for FT Interactive Data. He is an examiner for the Investment Management Certificate of the Society of Investment Professionals, and author of the accompanying Official Training Manual.

Andrew, Steve and their team are arguably some of the world’s leading experts on trend following, having published numerous papers on the subject. Should you wish to understand the subject matter in more detail, you might have a look at these two academic papers:

1. Reducing Sequence Risk Using Trend Following and the CAPE Ratio - Andrew Clare, James Seaton, Peter N. Smith, Stephen Thomas.

2. The Trend is Our Friend: Risk Parity, Momentum and Trend Following in Global Asset Allocation - Andrew Clare, James Seaton, Peter N. Smith, Stephen Thomas.

If you don't have the time or the inclination to be reading academic papers on finance (entirely understandable ;-) ), then all I would say is that I find their evidence for the efficacy of this simple technique extremely compelling as do a great deal of very sensible folk who are immeasurably cleverer than I am.

Since today's article has run quite long again - I will leave it there for today but I hope that you can see how this approach to investment - owning the world, investing regularly and using basic trend following - can have a revolutionary impact on your ability to make money over time whilst significantly reducing your downside risk. Through thick and thin this approach has a very long track record of maximising your chances of making consistent returns whilst protecting the downside when markets crash. Arguably more important than that, however, it significantly increases your ability to sleep well at night and ignore all the noise and stress that comes at you every day from the media.

In the very near future I will write more on the nuts and bolts of how you might actually implement these ideas with ease. Watch this space...

This blog post was taken from Andrew Craig's site Plain English Finance. Andrew is the author of How to Own the World: A Plain English Guide to Thinking Globally and Investing Wisely.

The Writer's views are their own, not a representation of London South East's. No advice is inferred or given. If you require financial advice, please seek an Independent Financial Adviser.