- Home

- Share Prices

- AQSE Share Prices

- Euronext

- Stock Screeners

- Share Chat

- FX

- News & RNS

- Events

- Media

- Trading Brokers

- Finance Tools

- Members

Latest Share Chat

A view on financial markets - Climbing a wall of worry

Thursday, 6th January 2022 16:15 - by David Harbage

The hope the Covid infection, with its adverse economic consequence, would be receding by the end of 2021 has been confounded. The Omicron variant appears to be a particularly virulent, if milder, infection prompting governments to re-introduce punitive measures which is impacting travel and hospitality in particular. Geo-political issues represent another concern for investors, with a large Russian military presence on its border with the Ukraine and diplomatic relations between the United States and China remaining tense. Another perennial worry concerns the strength or otherwise of global economic growth, as central bankers wrestle with the need to stimulate faltering Covid-restrained business and consumer demand even as higher inflation persists.

There is a well-known saying, “financial markets climb a wall of worry” and that seems to have been borne out over the past month and in 2021 as a year. Indeed one could go further and suggest that the bull market in equities which has, exceptionally, lasted for more than a decade (since the financial crisis of 2008) has been one in which investors have rarely felt comfortable. The lesson, perhaps, is that investors must learn to live with uncertainty – it is a fact of life.

Experienced stock market investors have become accustomed to such uncertainties and, possessing confidence in ‘animal spirits’ (which economist John Maynard Keynes referred to “as the instincts and emotions that guide human behaviour”), one can expect entrepreneurs and consumers to facilitate a bounce-back from the cautious climate of the past two years and sentiment towards owning real risk assets to improve in 2022 and 2023. However, in the very short-term, markets are likely to experience heightened volatility as fears of draconian (and perhaps unnecessarily harsh) ‘lockdown’ measures remain.

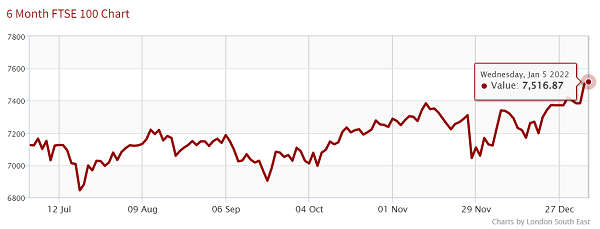

The prospect of interest rate hikes, prompted by higher than forecast inflation, arriving sooner than most of us expected is something that financial markets are likely to ‘take in their stride’ – but only if such rises are relatively small and perhaps restrained, (if not contra-indicated, by mixed forward-looking economic evidence). The Bank of England’s 15 basis point rise – from 0.1% to 0.25% - on 16 December came in response to domestic inflation reaching 5.1% and a warning that the UK’s consumer price index could rise to 6% by the spring of 2022. However the FTSE 100 index rose on that day and has subsequently progressed further, amid a belief that Omicron is likely to be a relatively mild version of Covid, with an encouraging take-up of booster vaccinations by the UK’s adult population, and a full economic lockdown could be averted.

Supply shortages have been a global contributor to price hikes with inflation in the US and Europe rising even faster than in the UK. In mid-December we learnt that US producer prices rose 9.6% in November, and the Federal Reserve (America’s central bank) guided expectations towards three hikes next year, three more in 2023 and two in 2024 – taking US rates to 2%, as well as indicating a longer-term rate of 2.5%. Last night’s publication of the minutes of the Fed’s latest meeting suggested that a rate hike could arrive in the first quarter of this year and that quantitative easing has ended. The latest German consumer price index showed annual inflation of 6%, with a double-digit rise in energy prices (caused by a shortage of gas) being the prime contributor, although the Bundesbank’s assertion that this represents the peak may be compromised by evidence of higher than expected wage growth.

History has shown that real assets, like property and businesses, are the natural beneficiaries of higher inflation while cash’s attraction in real (after taking account of inflation) terms becomes yet more negative – even as absolute interest rates may appear more attractive. In the writer’s working lifetime, the magnitude of higher prices and interest rates was in the mid-1970s as the Bank rate reached 15%, but became a negative real (consider deteriorating purchasing power) one of 8% as domestic inflation reached 23%. While such cost of money and absolute levels of inflation are most unlikely to be seen, savers’ returns on cash deposits appear set to remain in negative territory.

By contrast with Cash’s unappealing returns, the current dividend yield on the FTSE 100 index is 3.9% and the potential for further growth in corporate pay-outs in 2022 suggests that UK equity is likely to remain attractive to long term savers as a source of both immediate income and growth in such income (via dividend increases). While speculators and traders might have a different perspective, most institutional and retail investors with the appropriate long term perspective will be most mindful of the income stream and view capital appreciation as a secondary, but natural, consequence of owning company stocks. Within a longer-term investment strategy, it is important to maintain a broad spread of such equity holdings – featuring various types of asset and minimising the risk of losses from any individual security, via a diversified portfolio – rather than try to capture every small nuance as new information or opinions emerge.

In the last quarter of 2021, most real assets like company stocks and property delivered positive total (taking account of capital and income) returns. Looking forward, fund manager surveys, featuring consensus forecasts from the major London-based investment banks for the next twelve months, show a preference to be overweight in company shares – with a return of 8% forecast for the UK equity market, arising from 4% dividend income and 4% capital appreciation. The latter implies further de-rating of domestically listed company shares as earnings are set to rise by a high single-digit (after a near 30% bounce-back from 2020’s depressed results) with profit growth in the US and European progressing at a similar pace. In addition to a better than expected recovery in dividend pay-outs in 2021, investors witnessed the highest ever level of merger and acquisition activity of UK plc – which extended to private, as well as stock market quoted, businesses.

Although interest rates are set to be hiked further over the next twelve months, with Bank rate ending the year close to 1%, corporate balance sheets are remarkably robust with most debt locked in at low fixed rates. However, while servicing credit is unlikely to be a severe headwind for most large businesses, the prospect of a further lockdown of the economy remains a real concern - as is the ability of firms to pass on higher input costs to their customers. In such an environment, fund managers have spoken about the quality filters which they employ to ensure the sustainability of their selections’ business model and survival. The author endeavours to monitor fund managers’ activity, strategies and forecasts – typically via factsheets - and it has been reassuring to see ebullient soundings – especially in the medium and smaller size company segment (both UK and overseas) – over the past few weeks, even as the Omicron variant of Covid and inflationary concerns have dominated investor sentiment.

Although mindful that the US stock market appears highly valued (in particular the high technology businesses which are expected to continue to ‘disrupt’ traditional industries), history has shown that the final leg in a bull market can deliver particularly strong returns and therefore investors can seriously miss out by exiting early. Risk assets – in the form of company shares (be they listed on stock markets or not) and property assets advanced in the final quarter of 2021 despite the headwind of slowing economic activity. After a flat autumnal period, the FTSE 100 index advanced to 7,500 this week, a level not seen since February 2020.

In the light of the heightened nervousness since the Omicron variant emerged, this might surprise some, but we would reiterate the previous blog’s comments that financial markets ‘prefer to travel, rather than arrive’ – and make a judgement about how the world will look in approximately 18 months’ time. If it is now considered, based on high levels of vaccination, that there is little more that can be done to counter an infection which is becoming milder, if more widespread, we may have ‘arrived’ and the focus of investors’ attention will turn to the next big exceptional risk event or phase in the economic or market cycle. Even if that issue is a major geo-political threat (for instance the Ukraine’s sovereignty), the market can still ‘travel’ in a positive direction, if more cautiously, as Covid-induced uncertainty recedes.

Turning to investments which have appeal, over the appropriate longer term, in offering relatively certain returns from particular assets at low expense, passive replication of major indices is a good starting point. For example the i shares UK inflation index linked gilt Exchange Traded Fund (ETF) provides exposure to sterling-denominated British Government stocks whose income and capital redemption worth is linked to domestic inflation and the i shares Global inflation government bonds ETF that owns and tracks equivalent overseas securities. These investments, chosen for their ability to preserve capital rather than enhance its worth in real terms, will appear in most professionally managed diversified portfolios, and in particular pension funds.

Looking beyond those low cost asset replicators, one could delegate individual selections within a portfolio to a fund manager where there is confidence that they can outperform a benchmark or are capable of producing an incremental return not offered by an index tracker. This ownership of such actively managed investments is most popular when seeking areas of specialism, probably equity and flexible assets. Responding to a request for favoured actively managed investments (which are not personal recommendations), the following assets appeal:

UK smaller and medium sized companies – in expectation of an upward re-rating of domestic businesses (as UK economic growth is forecast to exceed most of the G7 in 2022), reflected in asset appreciation, dividend growth, a tightening discount between share prices and their underlying portfolio worth, alongside more takeover activity by overseas buyers. The writer favours: Aberdeen Smaller Companies Income (ASCI), Aberforth Smaller Companies (ASL), Downing Strategic Micro-Cap (DSM), JP Morgan Mid Cap (JMF), Mercantile (MRC), North Atlantic Smaller Companies (NAS) and Schroder UK Mid Cap (SCP) investment trusts. While this segment of the UK equity market outperformed larger companies in the first nine months of 2021 – as profits exceeded forecasts - the final quarter of the year saw some of these gains given back as the more defensive business activities found in the FTSE 100 index drew favour.

UK larger capitalised equity – beyond the i share FTSE100 ETF (CUKX), which tracks the index, best known for its attractively valued multinationals, investors seeking to outperform the FTSE 100 may consider investigating Finsbury Growth & Income trust (FGT) which features high quality (sustainable revenue) growth businesses and also the Value-biased, thematic Independent investment trust (IIT). Last year, progress was steady, rather than spectacular, in this segment of the market despite a growing number of high profile commentators querying investors’ neglect of UK listed large companies – seemingly 20% under-priced compared to US equivalent businesses.

Private equity and Flexible assets – these managers of businesses which are not listed on stock markets often feature a bias to the technologies of the future, notably in healthcare or web-based solutions. They are able to manage businesses out of the public glare for longer than historic private equity practice and, unlike the industry leader 3i (III), there are a number of less well known peers which feature double-digit discounts to their portfolio valuations, including: Caledonia (CLDN), Harbourvest Global Private Equity (HVPE), ICG Enterprise (ICGT), Pantheon (PIN) and Standard Life European Private Equity (SLPE). In the final quarter of the year, each of these trusts registered double-digit returns to extend the gains which made these assets a most rewarding area for investment in 2021.

Global equity – with a focus on medium sized companies BMO Global Smaller Companies (BGSC) and TR European Growth (TRG), as well as those offering valuation attractions. In particular, asset backed, Japan-focused AVI Global (AGT), and two deeply discounted (to asset worth) trusts: geographically-diversified Brunner (BUT) and US-biased Pershing Square Holdings (PSH).

Specialist assets – feature big warehouse property Tritax Eurobox (EBOX), global infrastructure spend Ecofin Global Utilities & Infrastructure (EGL), industrial asset-biased Picton Property Income (PCTN) and European industrial & residential TR Property (TRY) (which features European industrial & German residential assets) investment trusts. This diverse mix of investments produced pleasing returns in the final quarter of the year; asset appreciation was driven by higher occupancy levels and improving rental receipts.

Continuing the pattern of reviewing performance of previously mentioned investments, the final three months of 2021 produced positive returns from almost every asset class – the only exception being UK medium and smaller company segment, which encountered profit taking (despite seeing earnings exceed expectations and a high level of take-over activity) after a strong showing earlier in the year.

- Catch up with David's previous articles here

Despite greater debt issuance by the UK’s Debt Management Office and those overseas, government inflation linkers and high quality corporate debt produced positive total returns. We retain our view of the conventional fixed income market: with rates being so low, they can only go in one direction over the medium-term and therefore fixed rate bonds have limited appeal. While inflation linked gilts provide some insulation from inflation (in the UK, income coupons and eventual redemption values are based on the retail price index RPI and, from 2030, will be linked to the consumer price index including housing costs CPIH), the prime attribute of bonds surrounds their offer of stability in the credit ‘ladder’ – notably, as compared to potentially more volatile equity and real estate assets.

Prudent investors should never ‘put all of their eggs in one basket’ and should retain readily accessible cash to meet planned, as well as unforeseen, liabilities – before considering more volatile (in the short term) stock market-based investment proposition. Accordingly, maintaining a healthy Cash balance prevents investors having to sell an asset at an inopportune time as well as being able to make astute purchases (when prices fall in response to a perceived crisis).

Gold can also be seen in that light, as quasi-cash as well as being a defensive ‘safe haven’ asset. After enjoying a very strong 2020, the price of gold struggled to follow a decisive path in the last calendar year, settling 2% lower to close 2021 at $1830 per ounce – reflecting geo-political tensions, notably in Afghanistan, Hong Kong, Ukraine, but also speculative investor’ appetite for other alternative assets like crypto-currency.

Bottom line, looking forward, inflation data is set to remain high in the first half of 2022 but, as comparators become easier, the headline rate should peak by the summer and retreat in the second half of the year. Central banks will be mindful of fragile consumer confidence when setting rates; certainly, governments will be keen to see the cost of debt stay relatively low given the magnitude of their indebtedness. If the projected rate profile from the US central bank, as mentioned earlier, comes about, then the outlook for the US and in all probability the global economy takes on a benign appearance that markets can warm to.

With Covid infection likely to be a big influence on global economic activity in the first half of 2022, GDP growth is likely to be below par (after 2021’s bounce-back), and investment selections – in terms of asset allocation and choice of funds or individual securities – will be critical. Pessimists are forecasting a re-run of 2020, when markets were slow to recognise the coronavirus threat but succumbed to significant selling and plummeted sharply in March. Retaining a longer-term confidence in real investments, long term investors should not be tempted to liquidate portfolios but rather could view any fall as an opportunity to add to risk assets. With a much higher level of vaccination in place, the developed world is better positioned to withstand the current ‘storm’ - although one must accept that many individual businesses will struggle to survive another protracted lockdown.

The Writer's views are their own, not a representation of London South East's. No advice is inferred or given. If you require financial advice, please seek an Independent Financial Adviser.