FOREX

The yen remains the centre of attention for currency traders. The markets are still digesting the shock caused by the Bank of Japan’s decision, to allow the yields on the country’s government bonds to fluctuate within a wider range. The move is seen by many as the first step towards exiting the dovish stance of the last few years. The BoJ, the last major central bank still maintaining a very accommodative monetary policy, could be preparing the ground to start tightening policies, after November’s inflation reached levels not seen in four decades. Against this background, the yen gained almost 3.75% on the US dollar over the last two trading sessions, with expectations of further hawkishness from the Bank of Japan supporting a bullish outlook for the currency.

EUROPEAN SHARES

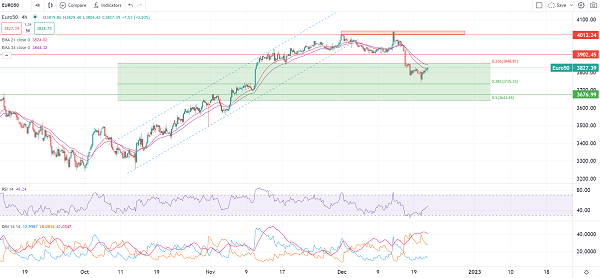

Benchmarks extended Tuesday’s gains in Europe this morning, alongside US futures, providing investors with a little relief following one of the most bearish week in months for equities.

Both French and German indices lead the way on the old continent, driving the STOXX-50 index above the 3,800 pts mark as bull traders managed to take back control of the market above 3,740 pts (38.2% Fibonacci), at least temporarily. Even if yesterday’s bullish price action is being confirmed so far today, investors are likely to remain cautiously optimistic this week. As long as no significant resistance (3,850pts / 3,900pts) gets cleared, the current rebound will remain as a “bullish correction” sparked by short-covering operations before the Christmas holiday, when market liquidity tends to decrease, rather than a clear trend reversal. In addition, the recent instability spotted in bond markets following Japan’s surprise shift in its yield trading band doesn’t offer a supportive environment for risk appetite.

Canadian CPI data, US CB Consumer Confidence and Existing Home Sales may increase market volatility today while energy stock investors will still pay close attention to today’s data as the US Crude Oil Inventories loom in the afternoon.