- Home

- Share Prices

- AQSE Share Prices

- Euronext

- Stock Screeners

- Share Chat

- FX

- News & RNS

- Events

- Media

- Trading Brokers

- Finance Tools

- Members

Latest Share Chat

Base metals thrive and you could take advantage in the mining shares

Friday, 12th February 2021 09:34 - by Rajan Dhall

Commodities have been very mixed this week. I would like to concentrate on the base metals as they have been on a great run in 2021 and the last week was no exception. Remember, over the next week China and some other nations will be off for Golden week (Lunar New Year). China consumes around 51% of all base metals worldwide so it will remain to be seen if supply will tighten while they are off or if producers have orders in place for their return. Either way, the volume in the base metals markets will be much lighter.

The background of the weaker USD have underpinned the performance in the commodities markets. Only really gold and natural gas have not taken advantage of the softer greenback. Having said that the strength in the pound has made US commodities companies more attractive as what would be the point in buying Shell (LSE:RDSB) or BP (LSE:BP.) when you could have Chevron (NASDAQ:CVX) with a discount.

As Joe Biden has now won the US Presidential race there could be a spate of infrastructure spending. This has led some manufacturing companies like Caterpillar and Freeport McMoran to increase in value.

Dr Copper has been in a great trend now and since the 20th March low the price is now over 90% higher. The buy on dips scenario is still in play until the market makes a lower high lower low or breaks out of this channel formation. The volume histogram at the bottom of the chart also shows that the market is backing the move too. This CME futures volume data seems to be increasing when the buying volume steps in and conversely on the red bars the volume is lighter.

Source: TradingView

The electric vehicle market is also booming at the moment and in the US companies like NEO and Blink Charging company have performed very well since mid-2020. Looking closer to home Bacanora Lithium (LSE:BCN) have been a good play as they nickel focused projects seems to be pushing the share price in the right direction. The chart below is the daily Global X Lithium & Battery Tech ETF. Its a good one to follow if you are looking at companies and minerals that are directly related to battery technology miners. As the market has grown in popularity it has now consolidated into a sideways pattern if there is a breakout then the EV companies could be back on the map.

Source: TradingView

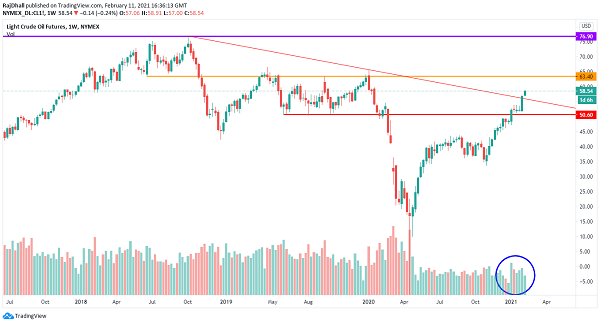

The WTI weekly futures charts have been breaking levels left, right and centre. The price is now firmly above the $55 per barrel level and a major trendline marked in red has now been broken. The next major level on the way up is now the gold resistance zone at $64.40 per barrel. If the price does move lower there could be a trendline retest or another test of the red horizontal line at $50.60 per barrel.

There has been lots of commentary from OPEC and the EIA this week. The EIA said that world oil demand is set to grow by 5.4 mb/d in 2021 to reach 96.4 mb/d, recovering around 60% of the volume lost to the pandemic in 2020. They added "while oil demand is expected to fall by 1 mb/d in 1Q21 from already low 4Q20 levels, a more favourable economic outlook underpins stronger demand in the second half of the year. The incorporation of new data lowered the 2019 baseline by 330 kb/d".

OPEC also see some positivity on the horizon as they stated they see 2021 world oil demand rising by 5.79 Mln BPD. Having said that this is lower than the previous estimate of 5.90 Mln BPD. Lastly, they said the oil demand is forecast to pick up in the second half of 2021.

Source: TradingView

The Writer's views are their own, not a representation of London South East's. No advice is inferred or given. If you require financial advice, please seek an Independent Financial Adviser.