- Home

- Share Prices

- AQSE Share Prices

- Euronext

- Stock Screeners

- Share Chat

- FX

- News & RNS

- Events

- Media

- Trading Brokers

- Finance Tools

- Members

Latest Share Chat

Andrew Craig Blog: Record low interest rates, record high stock markets

Monday, 29th March 2021 15:11 - by Andrew Craig

What can you do?

It is pretty clear that one of the biggest challenges facing people at the moment is the toxic and rather scary combination of interest rates at record lows and stock markets near record highs. This is a real conundrum for investors – and that is putting it mildly.

There are two pretty nasty problems caused by low interest rates in particular:

First: Returns on “lower risk” or “balanced” portfolios (combining shares and bonds) are too low for you to make decent forward progress as you save and invest through your working life. If a big chunk of your money is only making 1-2% a year, your ability to build a decent pot through your working life is hugely challenged.

Secondly: The “risk free” income you can make on your pot when you do hit retirement is very low – and too low for many people.

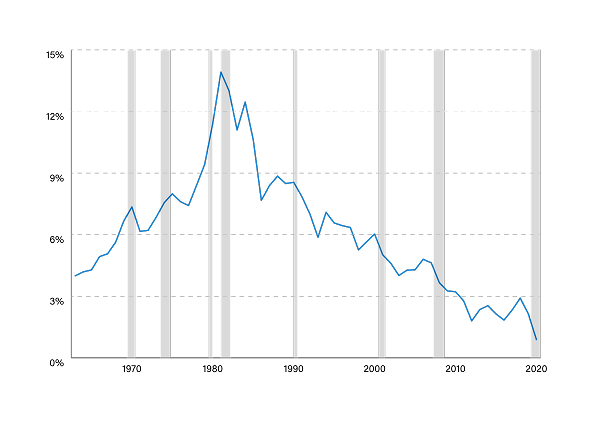

10 Year Treasury Rate - 54 Year Historical Chart as of 06/12/20 from MacroTrends.net

The chart above shows that interest rates have averaged roughly 6% since the early 1970s and have been much higher than that at times. Today they’re more like 1% (if you’re lucky).

For much of the last fifty years, if you were able to retire with a pension pot of, say, £1m (to keep the maths easy) – you could have expected £60,000 or even £80,000 or more a year of income from that pot – with no risk of loss. That was how the whole pension system worked.

With interest rates at more like 1% today – this number is now more like £10,000. I would argue this is actually one of the biggest problems of our age – and could be far more consequential than Brexit or even Coronavirus in the long run, for example, yet gets perhaps 1,000th of the press coverage.

Faced with such low interest rates, many millions of people all over the world have been forced to chase higher returns – by owning the stock market (equities) instead of interest-rate products (bonds and cash).

I have written about this a fair bit over the years;... but this is one of the reasons that stock markets have had such a long and strong bull market. Trillions of pounds, dollars, euros et al. have had to compete for the relatively small number of quality companies listed on global stock markets.

The problem is that “higher return” stock markets are inherently riskier and more volatile than “risk free” interest rates (from bonds or cash) – and the higher stock markets go, the riskier and more volatile they become of course, all other things being equal. At some point the music is likely to stop.

History shows us that stock markets tend to crash every few years – invariably by 50% or more. No-one can say precisely when they will do this next – but we can be pretty certain that they will eventually.

Three Stock Market Risks…

There are three risks that are particularly relevant when it comes to these big stock market crashes. I have found these to be poorly understood – by the general population and, indeed, by the mainstream media:

01. Psychological risk...

One reality that I think is too seldom discussed is the risk that people give up on investment altogether having endured a large crash. This happens time after time. When people give up on financial markets at such times and decide they will only ever hold cash and property perhaps, this then locks in that large loss and, more importantly, means that individual will then never benefit from compounding meaningful returns over time for the rest of their life. This is a disastrous result for millions of people.

02. The break-even fallacy...

It is a mathematical fact that a 100% gain is required to recover a 50% loss. This is also poorly understood, particularly at the moment. This means that protecting against a fall of this sort of size should be a materially higher priority than aspiring to make (unrealistically) high returns. Because of the way that maths works at a fundamental level, it takes many years of above average returns to recover a very large loss. For this reason, it is considerably more important for your long run success as an investor that your first focus should be on avoiding large falls rather than seeking to make unrealistically high returns. No matter where the bitcoin price may or may not be at the moment, I fear crypto investors may end up learning this lesson in the fullness of time, for example.

03. Sequence Risk...

Two assets with identical annualised return and volatility numbers give entirely different real-world outcomes depending on when in their life an individual experiences a big market crash. This can be a six- or even seven-figure difference. I explain this in some detail, with examples, from page 14 of this document.

What to do?

With interest rates and stock markets doing what they’re doing at present – what investors need is stock market returns but with far lower than stock market risk.

We believe that there is a way you might be able to achieve this – in the long run at least – by using a combination of two elegant investment techniques:

1. TRUE diversification:

All major asset classes in all major regions of the world. The main asset classes: Shares, bonds, cash, property and commodities, respond differently to the various stages of an economic cycle: Growth, deflation, inflation, stagnation and so on. Diversifying by geography and by asset class significantly reduces risk and maximum draw down.

2. Formula-based trend following:

Looking at financial data as far back as practicably possible (we’ve gone all the way back to 1872 in our work for US equities for example) – across essentially all markets, academic research and real experience has shown that the positive or negative direction of any market is statistically more likely to continue than to reverse. Because of this, formula-based trend following improves returns and reduces volatility.

Combining these two approaches is what we do in our investment fund.

Addressing a couple of challenges...

Before I sign off today, I hope you won't mind my addressing two specific subjects:

1. Performance...

Above, I have suggested that we believe it may be possible to achieve roughly stock market returns (over the long run), but with much lower than stock market risk by combining two powerful investment techniques, both of which have a multi-decade track record of working.

Anyone who has followed our fund since launch more than three years ago will know that it has "gone nowhere" in that time. I believe it is important to address this challenge head on.

The key thing to highlight is that the number one focus of the product is on protecting against the risk of a very significant loss. As I’ve said above, this is because in a time like 1999/2000 or 2007 to 2009 where stock-markets will be down 50% or even more than that – your ability to keep and build real wealth will be extremely challenged by the three risks I have highlighted above.

Our strategy has shown a maximum peak to trough fall of c.10% (if you’d been unlucky enough to buy at the highest high and sell at the lowest low) and a worse down year of just over 6% (in years where the rest of the world was down far more than that – including 2018, for example).

Past performance is no guide of course, but assuming we do this again in future crashes - if we are down, say, 5% or so in the next massive crash, we will only need 6% to recover – and, the evidence is that people will be far less likely to give up and sell out too - because of the psychology point. This is potentially a far better long run result than lots of other approaches – even if it is a pretty tough sell with the S&P knocking on 4,000 and crypto folk believing they can make 10% a week!

Over many years of investing, this strategy therefore has a good chance of beating more volatile assets, even if it may not in a short term when they're all going crazy. The evidence is that it actually has a chance of making roughly equity market returns over the long-run with much less risk and volatility and a fraction of maximum drawdown than many financial markets – and equity (and crypto) markets in particular.

That could (should?) be attractive, particularly at the moment when interest rates on “risk free” assets are not far off zero and equity markets are at all-time highs – (i.e. all time risk) - and particularly for anyone at or approaching retirement - for whom a big crash in their pot would be catastrophic (i.e. losing 30-50% of the pension pot you might have spent 25-30 years building!).

A very unusual crash…

The fund has “gone nowhere” since launch. But I would highlight a very particular reason for this. It is to do, in large part, with how extremely unusual the coronavirus crash was in 2020. Big stock market crashes usually take 2-3 years to unfold. In the last two decades, the “dotcom” crash unfolded between roughly August 2000 and February 2003 and then the “global financial crisis” between November 2007 and March 2009 for example. The coronavirus crash which began in February 2020 was finished in just over a month. Crucially, the market (I’m using the S&P 500 here) regained its previous highs as soon as August, bouncing more than 45% by then. By the end of the year it had recovered more than 63% from the March lows. This was extremely unusual (one might even say unprecedented).

Candidly, this is the very most challenging scenario for our strategy – in terms of relative performance at least. Our approach is slow-moving and backward-looking. Historical evidence shows that this should work very well in a more “normal” crash which unfolds over 2-3 years. Our fund will remain in cash as markets fall and fall, month after month. We should protect our investors’ capital and can then make returns from that much higher level of preserved capital when markets recover.

When markets bounced as quickly as they did in 2020, however, we remained defensively positioned in cash for some months before our slow-moving signals led us to start putting risk back on, whilst many headline indices powered back to their previous highs – leaving our strategy a long way behind of course. This is the price we can sometimes pay for making downside protection our main aim but it in no way changes the merits of the approach in our considered opinion.

We were out of "risk assets" and almost entirely in cash from March 2020. This meant we were down about 7% at the bottom of the crash versus most major stock markets which were down some way more than 30%. However, because the approach is slow moving and backward looking (to achieve the robust defensiveness I’m talking about) – we then lagged markets when they all bounced so aggressively, and we stayed in cash for some months.

In any "normal" crash – i.e. one that takes 2-3 years to unfold like it did in 1999/2000 and 2007 to 2009 and in most crashes of the last two centuries, it is highly likely that this strategy ends up outperforming a great deal else and also that this could then remain the case for years afterwards, given the point about a 100% gain being needed to recover a 50% loss.

A mild mannered black swan...

In effect, 2020 was a “black swan” year for a strategy like ours, yet we ended the year down only 1.2% in absolute terms. I would suggest that this is a pretty mild-mannered black swan, and illustrative of the merits of the approach over the long run. Whilst this meant our performance was certainly disappointing relative to surging (and volatile) equity indices, we do feel that that the strategy continued to do what it is designed to do – i.e. seek above all else to protect against the risk of the sorts of very significant and consequential losses that will come from owning most financial assets at some time or other.

In a less volatile, trending market, the evidence of history is that the strategy should also be able to capture meaningful upside as well as protecting the downside. You can see the evidence for this on page 38 of this document.

Disclaimer: Simulated past performance is not necessarily a reliable indication of future performance.

2. Costs:

The Ongoing Charges Figure (OCF) for our Fund is currently 1.5%. This has also attracted a measure of (justifiable) criticism.

I think the simple point to make here is that this cost will come down assuming the fund grows. £30,000 of fixed cost carried over a £10m fund is equal to 0.3% of the value of that fund. It is only 0.03% of the value of a £100m fund, however (mathematically). If we succeed in growing assets under management, costs will come down over time. We are very hopeful that we should be able to do this for two main reasons:

First, we hit our three-year anniversary last October. This is a key “gating” event for many professional investors who simply won’t consider a fund before it has been around for three years.

Secondly, because (I am delighted to share) we have just been taken on by a specialist fund sales consultancy business. They have a list of more than 11,000 professional investors to approach (5,000 in the UK and 6,000 overseas). They started last week – and should be sharing the news of their appointment with their audience this week. It is perhaps worth my noting that these sorts of firms don’t usually work with a fund until it has more than £25m under management. Some won’t act for you until you have more than £100m. Our guys have made an exception because of their belief in our approach and, I would argue, the pedigree of the two finance Professors with whom we collaborate on the fund, Andrew Clare and Steve Thomas.

Of course, we can’t guarantee we will succeed in winning assets – but I have to hope that we now have our best chance since launching the fund by far. If we double the size of the fund and more, we will significantly reduce those fixed costs within the OCF. I am hopeful that the cost of ownership will reduce as the year goes on. I hope this helps and clarifies matters as far as the cost of the fund is concerned... (I would also reminder readers that all performance numbers are given AFTER costs for what it is worth).

I think that is all for today.

This blog post was taken from Andrew Craig's site Plain English Finance. Andrew is the author of How to Own the World: A Plain English Guide to Thinking Globally and Investing Wisely.

The Writer's views are their own, not a representation of London South East's. No advice is inferred or given. If you require financial advice, please seek an Independent Financial Adviser.