Pandemic effects hit US banks

It will not be an entirely negative earnings season for banks. On the positive side of things, banks will have reaped significant fees from the flow of initial public offerings (IPOs) and a bounce in corporate borrowing, which will help boost their bottom line for this quarter. But as the coronavirus pandemic goes on with no end in sight, concerns about the economic outlook are mounting.

The near-zero interest rate policy followed by the Federal Reserve (Fed) and the ongoing weakness in the broader economy continues to point towards a tough time for the banking sector. Companies still fear for the future, while workers are concerned that they will face unemployment further down the line as the US economy moves into another recession.

US economy faces tough times

It is a truism that banks are essentially a play on an economy. When the economy does well, so do banks. When it suffers, banks suffer too. This is something that bears repeating at every earnings season. This time around the US economy faces its biggest crisis since at least 2008, if not long before, and while the initial stimulus programme helped it to weather the storm, more will be needed. At present, there is little sign of any new stimulus, since both sides are unwilling to make compromises ahead of the presidential election. Thus markets have been left waiting for a stimulus programme that may be weeks away, if not more.

While a Joe Biden victory seems likely as we enter the final month before the election, there is no guarantee that the new occupant of the White House will be able to launch a stimulus effort straight away. A stimulus effort is seen as essential, in order to get the economy through until a vaccine arrives, but it may be a while before one arrives. Until then, the prospects for bank shares look tough.

US financials ETF: stock price technical analysis

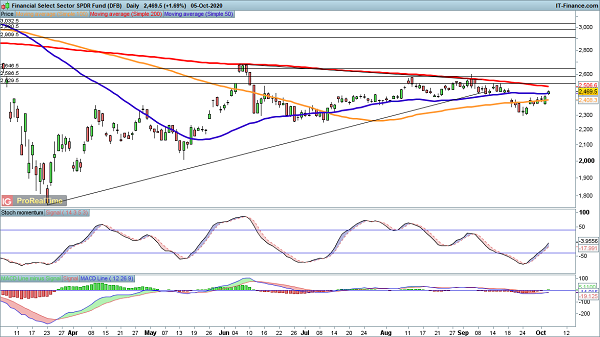

While the broader S&P 500 has only recently hit an all-time high, and remains in a strong position despite the September selloff, the same cannot be said for the US banking and financial sector. The SPDR Financial Select Sector exchange-traded fund (ETF), which covers the major banks, has failed to make much headway since peaking in June.

Gains into August and September stalled around 2560, with the latter bounce hitting the 200-day simple moving average (SMA), currently 2506, while September’s low was below the 2370 level seen as support in July, although it did not breach the early July low at 2250. It is positive that the price has moved back above the 50-day SMA (currently 2455), but it will need to clear the August peak to avoid creating another lower high.